Manage an SBIC U S. Small Business Administration

It encompasses a variety of day-to-day tasks, including basic data entry, categorizing transactions, managing accounts receivable and running payroll. For an additional fee, Bench offers catch-up bookkeeping if you're behind on your financials. It also offers limited support for business taxes by preparing a year-end financial package for your CPA. You can pay for additional tax services by adding BenchTax to your bookkeeping services. Outsourcing your projects to experienced tax pros or CPAs is one of the best ways to ensure that your business’s accounting needs are being met. They can help you with all aspects of accounting including cash flow management, business planning and budgeting, and tax returns for small businesses.

Cost comparison is a useful tool when choosing a small business accountant. Ask for recommendations from your business network or professional associations. People who have used an accountant's services can give you firsthand feedback on their performance. Ensure they have relevant experience in managing small business finances and are updated with current financial regulations and technologies. You don't have to worry about errors in your bookkeeping, missed tax deadlines, or financial decisions made in the dark.

Why You Can Trust Forbes Advisor Small Business

Under this method, you record income when you make a sale and expenses when you incur them. This is irrespective of whether you received or paid cash for the product or service. You must use a double-entry accounting system and record two entries for every transaction.

This will allow you to make better financial decisions for the long-term health of your company. Remember that a CPA is also very well paid, and although rates vary, they are typically much higher than an accountant’s. So, weigh your problems with what may happen if you don’t get professional help. If you do, and the IRS wants to take a look at your books, then you may need a CPA.

The plan includes unlimited expense tracking, unlimited estimates, accept credit cards and bank transfers, track sales, see reports and send unlimited invoices to up to five clients. We analyzed 13 providers across 20 metrics to rank the best accounting software for small businesses. Our ratings consider factors such as transparent pricing, variety of features, availability of support and customer ratings. Accounting costs vary greatly depending on the type of services you need. According to a 2015 survey of small business owners, most small businesses spend at least $1000 annually on accounting and legal expenses.

What does an accountant do?

The ability to extract, interpret, and utilize this data is a key skill for modern accountants. They must navigate the complex world of federal, state, and local taxes, ensuring that the business remains compliant while maximizing available deductions and credits. Every industry has unique financial nuances, and being able to navigate these can make an accountant an invaluable asset.

Sage Intaact’s robust dashboard is optimal if you want to access comprehensive financial visibility and data-driven insights across multiple businesses. And if you are looking for scalability and cost-effectiveness in your solution, one of Xero or Wave Accounting’s free or low-cost software plans may be the right choice for your business needs. Its lowest-priced plan, the Early plan, does limit Accountant for small business the number of invoices you can send per month, but it’s a great, cost-effective option for new users with fewer or smaller accounts. And if you require more software functionality, scaling up is easy, as Xero supports unlimited users and has relatively low prices across each plan. Automatica’s all-in-one cloud ERP solution provides many great features for managing multiple growing businesses.

Comparing Costs Among Accountants

Unless you are a CPA who is up to date on tax laws, you’re likely missing out on deductions and other small biz benefits. And once your business starts growing, you likely won’t have the time or knowledge to accurately keep track of all your books. Hiring a small business accountant is a valuable investment for most businesses. They can save you time, reduce stress, ensure compliance with tax laws, maximize tax savings, and provide crucial financial insights.

Of course, the most authoritative source for information about the ERC is the IRS. However, it can still be challenging to know whether your business ought to apply for the ERC — and that's where a qualified tax expert like Soria can help. It's understandable if businesses want to take advantage of the tax breaks that are available to them. The Employee Retention Credit may be one of those tax-break opportunities for qualifying businesses that continued to pay employees while shut down due to COVID-19 or saw declines in revenue. If you make those payments on time, then you shouldn’t have to worry about a hefty tax bill when you file your federal return.

Ways Small Businesses Can Handle Accounting

Below you'll find summaries of these applications, with an explanation of what makes them differ, along with what to look for when choosing the right software for your business. We also include links to the in-depth reviews of each software if you want to learn more. While many small-business owners opt to do their own accounting and bookkeeping, there may come a time when you decide to hire out these services.

$80bn for the IRS? Fund the US taxman, but not like this - The Guardian

$80bn for the IRS? Fund the US taxman, but not like this.

Posted: Sun, 20 Aug 2023 12:00:00 GMT [source]

You’ll need to consider factors directly affecting your business and the accountant’s services. You might want an accountant for any of the reasons we discussed above. Further, if you have had any big life changes recently, you’re self-employed, or you need to make changes to a previous year’s tax return, it’s also good to employ the services of an accountant. Hiring a bookkeeper may be a cost-effective solution for your business.

They translate complex financial data into understandable terms, helping business owners make informed, data-driven decisions. This ability to translate financial data into actionable insights is what makes an accountant truly valuable to a small business. These principles guide their work and enable them to provide accurate, relevant financial information.

How much experience does the tax advisor have delivering the kind of results I'm looking for?

Some accountants may charge a flat fee along with additional, variable rates. From here, you can consider how each solution would support these needs. For instance, the advanced features offered by Zoho Books make it a good option for streamlined data consolidation.

- Appendix 16 provides for two-digit number designations for major categories under which accounts are listed, and three-digit number designations for individual general ledger accounts.

- Nothing compares to using the products when considering which is the best.

- You just have to decide whether you want to spend the time upfront building your records or take time out when you're in the middle of sales or purchase forms.

Fixed fees, on the other hand, can provide more certainty and can be more cost-effective for ongoing, predictable services. Referrals and reviews can provide valuable insights when choosing a small business accountant. Are they able to understand your concerns and provide clear, helpful responses? A good accountant is not just a numbers person—they're a people person, too. An accountant's past performance can give you an idea of their competence and effectiveness.

Accurate accounting helps you do a lot, including maximizing tax deductions and making better financial decisions. They are the balance sheet, cash flow statement, and income statement. Are you aware that many business owners simply file their personal and business taxes together in one return? These types of businesses are referred to as “pass-through” entities. In late 2017, the Trump administration introduced the Tax Cuts and Jobs Act (TCJA). Although there are certain restrictions, the TCJA allows for a new tax break for small business pass-through entities, an equivalent of up to 20% of its income.

All the accounting services reviewed here come with default settings that you may need to change. For example, do you plan to use specific features such as purchase orders and inventory tracking? You can usually turn tools on or off, which can help you either simplify the user interface or maximize the functions available to you. There’s good news for business owners who want to simplify doing their books. Business owners who don’t want the burden of data entry can hire an online bookkeeping service.

Inventory tracking, accounts payable and receivable reporting, as well as tax preparation and filing, are add-on options for an additional fee. That's a comprehensive offering for startups or small businesses that want to scale up quickly. The next step is to work with your account manager to integrate your existing software and processes with QuickBooks. From that point on, you will receive monthly reports, including cash flow, profit and loss, and balance sheet statements. For additional fees, inDinero offers tax support for filing state and federal taxes for current or previous years. You also can add a fractional CFO to help with financial projections, cash management, business analytics, and budgeting.

What is your current financial priority?

A bookkeeper records business transactions and day-to-day operations. Their job is to manage bills, payroll, invoicing, and transactions with suppliers. Most bookkeepers monitor cash flow, create budgets, and manage accounts payables and receivables.

Kashoo is ideal for startups because it offers a variety of plans to grow with your business–including a free plan. Its trulysmall.invoices plan is perfect for sending an invoice, getting paid and tracking payments. Its trulysmall.accounting plan allows you to track income and expenses automatically. If your business needs double-entry accounting software, its kashoo plan allows for detailed reporting and customization.

Professional services biz BlueRock seeks growth capital partner - The Australian Financial Review

Professional services biz BlueRock seeks growth capital partner.

Posted: Sun, 20 Aug 2023 19:00:00 GMT [source]

It's the most comprehensive, customizable accounting program in this group of applications, though it does more than what many small businesses need, and it costs a bit more as well. The software offers built-in online connections that support some remote work, and it integrates with Microsoft 365 Business. Sage 50cloud Accounting is a powerful piece of software, so why didn't it receive a higher rating? A dated interface, lack of mobile access, and the requirement to install the software locally keep it from receiving a higher score. FreshBooks is actually a full-featured, double-entry accounting system that happens to offer an exceptional user experience. It has won numerous PCMag Editors' Choice awards for these reasons.

Small Business Bookkeeping 2023 Guide

QuickBooks is a good choice for freelancers and small businesses that need a simple way to track expenses, organize receipts and log mileage. You’ll need to pay higher rates for these accreditations since they portray credibility. Also, someone with a significant clientele is expected to have more experience, which will help your financial growth, so you should pay them more than a recent graduate. When manually doing the bookkeeping, debits are found on the left side of the ledger, and credits are found on the right side. Debits and credits should always equal each other so that the books are in balance.

Virginia budget battle depends on reaching revenue deal - Richmond Times-Dispatch

Virginia budget battle depends on reaching revenue deal.

Posted: Sat, 19 Aug 2023 12:08:00 GMT [source]

Does it cover all your accounting tasks, or are there extra charges for additional services? Make sure to clarify this upfront to avoid unexpected costs down the line. They need to be comfortable with a range of software for tasks such as bookkeeping, payroll management, invoicing, and financial reporting. Their scope of work ranges from bookkeeping, tax planning, and preparation of financial statements, to providing strategic financial advice. Generally, the small business owners think that their attitude towards accounting is trivial compared to cold hard cash.

NOW WATCH: WATCH: How small businesses can master their taxes in 2021

Kelly is an SMB Editor specializing in starting and marketing new ventures. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. Laura is a freelance writer specializing in ecommerce, lifestyle, and SMB content. As a small business owner, she is passionate about supporting other entrepreneurs, and sharing information that will help them thrive.

- It’s also worth noting that the free plan doesn’t enforce limits on income and expense tracking, bank and credit card connections, collaborators or accountants.

- Sign up for Lab Report to get the latest reviews and top product advice delivered right to your inbox.

- We offer flexible accounting plans to fit businesses small and large, across all industries, with integrations like payroll, time-tracking, and payments to help you grow efficiently when you’re ready.

- A source document or business document serves as the foundation for recording a transaction.

- We also recommend it to small businesses, growing businesses, and established businesses that want its customizability, depth, and usability.

This person should not only have the qualifications and experience to assist with taxes, but also have specific knowledge of the intricacies of business taxes. Small business accountants are professionals, often Certified Public Accountants (CPAs), who have the experience and knowledge to help owners navigate through their financial records. Depending on the size and needs of the business, these accountants may work on a monthly, quarterly or annual basis.

Estimating an Independent Contractor’s Federal Tax Liability

If you have less than $50,000 per year in revenue, you can sign up for the Zoho Books Free plan. It gives one user access, enabling them to manage clients and invoices, create recurring invoices, import bank and credit card statements, and track expenses and mileage. Accountants can help you understand and manage your company’s taxes, growth, and expenses.

It provides an overall view of the financial health of an organization, and includes components such as transactions, taxes, budgets and projections. They may not be the cheapest, but they should provide excellent value for money. Consider their qualifications, experience, and performance, not just their price tag. From recognizing industry-specific tax deductions to interpreting sector-related financial data, industry knowledge can enhance an accountant's effectiveness. Small business accountants ensure that a company's financial records are accurate, complete, and in compliance with accounting standards. It involves maintaining accurate records of all financial transactions, including sales, expenses, and payroll.

Some of the best small-business accounting software options include QuickBooks, Xero, and FreshBooks. Automation is a vital element of accounting software solutions, as it minimizes how long it takes to carry out tasks and streamlines processes for a more efficient workflow. For example, automated calculations in accounting tools save users effort and ensure accuracy by reducing mistakes due to human error. Automated tools can also notify people of deliverables for a faster and more efficient workflow. Wave is a fully free accounting software solution, unless you choose add-on services with extra fees. In this article, we’ll be looking at the top software tools for multibusiness management in 2023.

What is the simplest accounting software?

Wave is for sole proprietors and freelancers who need an online accounting service and may want a little room to grow. Integrated payroll and double-entry accounting support make it a potential option for small businesses with a few employees, though there Accountant for small business are better choices for those companies. And because it has a simple user interface, even financial novices could use it. At the end of every pay period, the bookkeeper will accumulate employee payroll details that include hours worked and rates.

They can handle the trips to the bank and troubleshoot discrepancies in the data captured by the software. While much of your daily accounting work probably involves paying bills, sending invoices, and recording payments, you also need to keep a close eye on your bank and credit card activity. If you have connected your financial accounts to your accounting service, then this is easy to accomplish. You can also view each account's online register, which contains transactions that have cleared your bank and been imported into your accounting solution (along with those you have entered manually).

- But independent contractors must make estimated quarterly payments on their own—if they expect to owe taxes of $1,000 or more when they file their tax returns.

- Once the entries are assigned to the correct accounts, you can post them to the general ledger to get a bird’s-eye view of your current cash status.

- Now, once you decide what services you need from a CPA, it’s time to start looking for one you would actually like to hire.

- In this episode, Harlem chocolate Factory founder Jessica Spaulding recalls a few of her early money management mishaps, and three big lessons learned.

- They ask how many of each product you have in inventory when you create a record and at what point you should be alerted to reorder.

- You should also browse the chart of accounts and make sure it’s organized in a way that makes sense for your business.

All you have to do is fill in the blanks and select from lists of variables like customers and items. Accounting services let you easily create any transaction that a small business is likely to need. The most common of these are invoices and bills, and most of the services we reviewed support them. You can go with the baseline plan, the Simple Start plan, for $30 per month. If you need more users, you need to move up to The Essentials plan for $55 per month. Whether you do the bookkeeping yourself or hire someone to do it, certain elements are fundamental to properly maintaining the books.

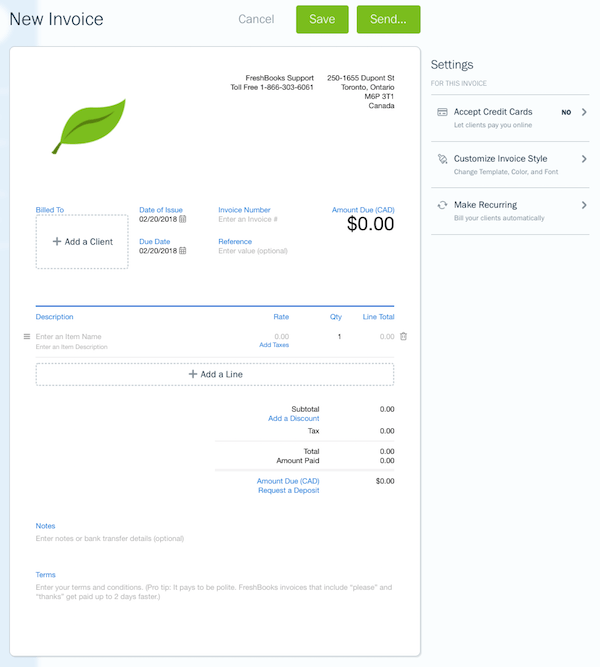

Sending Invoices

Learning how to track and record business transactions is the foundation of a strong small business bookkeeping system. You can record your financial transactions in a paper ledger or Excel spreadsheet, but using free accounting software saves a lot of time and helps avoid errors. Single-entry accounting records all of your transactions once, either as an expense or as income. This method is straightforward and suitable for smaller businesses that don’t have significant inventory or equipment involved in their finances. It doesn’t track the value of your business’s assets and liabilities as well as double-entry accounting does, though. Bookkeeping is the backbone of your accounting and financial systems, and can impact the growth and success of your small business.

This is a highly recommended method because it tells the company’s financial status based on known incoming and outgoing funds. Because the funds are accounted for in the bookkeeping, you use the data to determine growth. Alternatively, if you seek a unified solution with built-in connections and automatic data integrations, Intuit QuickBooks could be your best bet.

Though an overhead cost doesn’t convert into cash, it is essential for your business growth. Kathy Haan, MBA is a former financial advisor-turned-writer and business coach. For over a decade, she’s helped small business owners make money online. When she’s not trying out the latest tech or travel blogging with her family, you can find her curling up with a good novel. If you’re on a budget, you can reduce costs by opting for a less expensive plan, choosing à la carte options or only paying for the features you need.

And let’s assume you’re single, have no other income and claim the standard deduction. For simplicity, we will ignore certain tax credits and deductions, such as the Qualified Business Income deduction. Samriddhi is a content marketing professional at Invedus with a passion for capturing outsourcing trends and technology strategies. With experience in content writing, social media marketing, graphic design, and business analysis, she provides valuable insights. In her free time, she enjoys visiting tea shops in green hill stations.

This influences which products we write about and where and how the product appears on a page. It is totally appropriate to ask about their fees and how they bill. Some services may be a straight fee-for-service charged by the job, while others might be billed hourly. If you just need a CPA for a one-time audit or to file your taxes once, this may not seem like a big deal.

Personnel file: Aug. 15, 2023 - delawarebusinessnow.com

Personnel file: Aug. 15, 2023.

Posted: Wed, 16 Aug 2023 01:39:20 GMT [source]

These record templates vary in complexity, so you need to understand the differences before you go with one accounting service or another. Some, such as Patriot Software Accounting Premium, simply let you maintain descriptive product records. They ask how many of each product you have in inventory when you create a record and at what point you should be alerted to reorder. Then they actively track inventory levels, which provides insights on selling patterns and keeps you from running low.

Evaluate the overall value the accountant offers—their expertise, the range and quality of their services, their customer service,and their proven results. Some may charge a flat monthly fee for a package of services, while others may charge on a per-task basis. Some may offer a hybrid model, combining fixed fees with hourly rates for additional services. Do they have proven experience in handling industry-specific accounting issues? An accountant who knows your industry can be a valuable asset to your business. Do you need help with tax preparation, or are you seeking strategic financial advice?

Your accounting data can be tightly integrated with numerous related apps and functions, like CRM, customer service, and email. The first method of accounting is the cash-based accounting method. This method records financial transactions when money is exchanged. This means that you don’t record an invoice until it is actually paid.

How to Calculate Profit Margin

The gross profit margin calculation measures the money left from the sale of your goods or services, once the operating expenses used to generate them are deducted (e.g. labour and material costs). Gross profit is calculated by subtracting the cost of goods sold (COGS) from the total revenues. Profit margins are one of the simplest and most widely used financial ratios in corporate finance. A company’s profit is calculated at three levels on its income statement. This most basic is gross profit, while the most comprehensive is net profit. All three have corresponding profit margins calculated by dividing the profit figure by revenue and multiplying by 100.

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. The historical net sales and cost of sales data reported on Apple’s latest 10-K is posted in the table below. The COGS margin would then be multiplied by the corresponding revenue amount.

Resources for Your Growing Business

The gross profit margin compares gross profit to total revenue, reflecting the percentage of each revenue dollar that is retained as profit after paying for the cost of production. A company’s gross profit percentage measures the profitability of its business based on numerous factors. More specifically, it expresses the percentage of the money you’ve made from selling a product or service after accounting for the cost of sales or production. Generally speaking, business owners want their gross profit percentage to be as high as possible as this represents the amount they can take home after a job well done. It measures how efficiently a company can use its cost of production to produce and sell products profitably. Gross profit margin is simply a way to show your gross profit in a ratio or a percentage, instead of a dollar amount.

Companies can also use it to see where they can make improvements by cutting costs and/or improving sales. A high gross profit margin is desirable and means a company is operating efficiently while a low margin is evidence there are areas that need improvement. To determine gross profit, Garry would subtract COGS ($650,000) from his total revenue ($850,000). For the purposes of gross profit, he would ignore the administrative and salary costs on his company’s income statement.

What Is Gross Profit Percentage?

As a standalone metric, the gross income is not very meaningful, which is the reason that it must be standardized by converting it into percentage form. To learn more about gross profit and how to manage it strategically for business growth read our latest article What is Gross Profit? There is a wide variety of profitability metrics that analysts and investors use to evaluate companies. Profit margin can also be calculated on an after-tax basis, but before any debt payments are made. There is one downfall with this strategy as it may backfire if customers become deterred by the higher price tag, in which case, XYZ loses both gross margin and market share. Deanna deBara is an entrepreneur, speaker, and freelance writer who specializes in business and productivity topics.

It can be quite surprising how informative and powerful such a simple formula can be. The gross profit percentage formula is super simple and easy to calculate if you know what you’re looking for within a company’s financial reports. However, you’ll need to prepare by gathering the information needed in the gross profit ratio formula.

Gross Profit Example: Apple (NASDAQ: AAPL)

Gross profit percentage is the percentage of money you’ve made from selling a good or service after you subtract the cost of producing that good or service. Ms. ABC owns a furniture business that designs and manufactures high-end furniture for offices and residential. She has several different types of furniture and has proven to be one of the most successful https://turbo-tax.org/accessories/ brands in her space. Below is the information appearing on the profit and loss statement at the end of the financial year 2022. As an example, by analysing your margins, a business will be able to pin-down related price increases due to unexpected economic disruptions. Marking up goods (selling goods at a higher price) would result in a higher ratio.

- Gross profit margin is a measure of profitability that shows the percentage of revenue that exceeds the cost of goods sold (COGS).

- It can signify strong demand for the company’s products or efficient operations.

- When you start monitoring your gross margin balance, you can measure your performance against an industry benchmark to assess how you're performing in your field.

- Gross profit is different from net profit, also referred to as net income.

- For every dollar of sales revenue, this firm generates about 19 cents of gross margin.

Gross profit margin is the profit after subtracting the cost of goods sold (COGS). Put simply, a company's gross profit margin is the money it makes after accounting for the cost of doing business. This metric is commonly expressed as a percentage of sales and may also be known as the gross margin ratio. Both the total sales and cost of goods sold are found on the income statement. Occasionally, COGS is broken down into smaller categories of costs like materials and labor.

Gross Profit Calculator — Excel Template

This means that for every dollar of sales Monica generates, she earns 65 cents in profits before other business expenses are paid. Based on industry experience, management knows how many hours of labor it takes to produce goods. The hours, multiplied by the hourly pay rate, equal the direct labor costs per product. From 2019 to 2021, Apple’s gross margin averaged approximately 39%, but from our analysis, we know that its margins are particularly weighted down by the products division. Suppose we’re tasked with calculating the gross profit and gross margin of Apple (AAPL) as of its past three fiscal years. You can do both of these things easily using the digital expense management tools that come with the American Express® Business Card.

What is Net Profit Margin? Formula for Calculation and Examples - Investopedia

What is Net Profit Margin? Formula for Calculation and Examples.

Posted: Tue, 28 Mar 2017 08:23:18 GMT [source]

Tax Services for Independent Contractors in Phoenix AZ H&H CPA

Content

They tend to get paid for projects, they worry about their own taxes, and work when and where they want. Both of the packages offer a free demo so you can check them out to see if the service is right for your https://www.digitalconnectmag.com/a-deep-dive-into-law-firm-bookkeeping/ business. Several customers on third-party review sites report problems reaching customer service or receiving a response to their problems. You can also add on payroll through Gusto starting at $40 per month.

- Third-party customer reviews point to significant problems reaching customer service and getting resolutions to their problems.

- → As an independent contractor, you receive 1099s at the beginning of the year for the previous calendar year.

- Many or all of the products featured here are from our partners who compensate us.

- Furthermore, the relationship is with the employer as a whole.

- It became apparent to me that it was time to make the switch from independent contractors to employees.

You’ll report these deductions along with your income on Schedule C. Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial. When you submit Forms 1099-NEC to the IRS, you must also send Form 1096. If you have control over the project, the worker might be an employee.

The Complete Guide to Independent Contractor Taxes

The paperwork previewed in the image will provide the structure and language for an Accountant/Bookkeeper to solidify a Client job. It may be downloaded by clicking any of the buttons in the preview image’s caption area or through the links above. Make sure your software is up-to-date before working on your copy. If you do not have the appropriate PDF editor or word processing software then, use your browser to view, save, and print a copy to fill out manually.

No, if you are an independent consultant or distributor for a direct sales or multi-level marketing company you are also required to report your income on Schedule C (Form 1040). As Navigating Law Firm Bookkeeping: Exploring Industry-Specific Insights explained earlier, if you have net profits of at least $400 you’ll also need to file Schedule SE. To calculate the self-employment taxes mentioned above, you’ll use Schedule SE.

Common Features of an Accounting Contract

These bookkeeping software includes QuickBooks, Xero, FreshBooks, and etc. → As an independent contractor, you receive 1099s at the beginning of the year for the previous calendar year. The income on each 1099 is reported to the IRS, meaning any discrepancy on your tax return is likely to raise some red flags.

- You should receive a 1099-MISC from each company confirming how much they paid you during the year.

- Typically, accounting apps for independent contractors will help with organizing and storing records and receipts, keeping track of accounts payable and accounts receivable, and performing bookkeeping tasks.

- There are free and paid versions, and typically the paid versions have more features.

- While there are charges for some extra features like payment processing, payroll, and bookkeeping support, the free starting price point makes it a winner for many independent contractors.

- An independent contractor agreement for accountant and bookkeeper is an important document to determine, for tax purposes, that the worker is not an employee of the company.

- This service is designed to help independent contractors predict their customer demand and be prepared for it.

Once they provide you with a W-9, you can discontinue backup withholding, but the best practice is, get the W-9 upfront, and do not engage in business with those who will not comply. You see the list here, but the one that affects most photographers would be the attorney fees. This means that you need to report all payments to an attorney regardless if they are an S or C corporation. Reportable payments to corporations tell us the following payments made to corporations generally must be reported on form 1099 miscellaneous.

Customized Service

A W-9 provides personal identifying information about an independent contractor, like name, address tax identification number, and tax classification. You can treat anyone working for you as an employee and it will not concern the IRS or your state government as long as you follow the employment rules and laws, and pay all employment taxes due. If you want to treat workers as independent contractors, review the rules and get professional advice to ensure the classification of independent contractor is supportable under both the IRS and your state laws. For example, in CA the first question to ask in determining whether a person can be an independent contractor is what is industry. See LA Times article, California’s top court makes it more difficult for employers to classify workers as independent contractors and CA Assembly Bill No 5, Section 621(b). The Borello test does not guarantee the worker can be an independent contractor.

The costs of accounting software for independent contractors vary. There are free and paid versions, and typically the paid versions have more features. Some apps offer free 30-day trial periods and others offer discounts for paying annually in advance. Some workers may prefer to be classified as independent contractors because employees are not permitted to deduct unreimbursed employment expenses on their personal tax returns.

Hire a Bookkeeper

Typically an independent contractor will first send you an invoice, which will specify certain payment terms. Depending on your accounts payable process, you might also send them a purchase order back to confirm the invoice before issuing the final payment. Remember that as an independent contractor, you’ll have to set aside all of your self-employment taxes, Social Security, and Medicare contributions yourself. Schedule SE is one of many schedules of Form 1040, the form you use to file your individual income tax return.

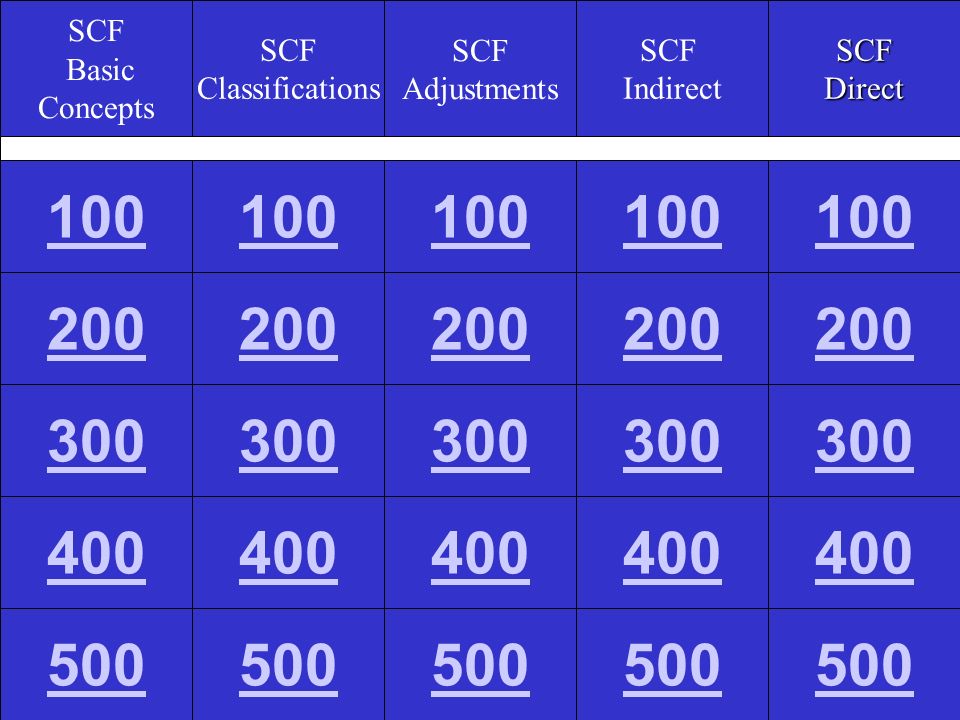

3 3 Define and Describe the Initial Steps in the Accounting Cycle Principles of Accounting, Volume 1: Financial Accounting

Content

A general ledger is the “master” document that summarizes the transactions and the company’s financial position. Posting transactions refers to the posting of entries from the journal to the general ledger accounts. General ledger accounts are accounts that have their own unique numbers and categories. When posting entries, the entries will be transferred to the account that is affected by the respective entry. For example, if the cash account in the journal is debited, the entry will be posted to the respective cash ledger account, which will be debited the same amount as recorded in the journal.

It's important because it can help ensure that the financial transactions that occur throughout an accounting period are accurately and properly recorded and reported. This can provide businesses with a clear understanding of their financial health and ensure compliance with federal regulations. The accounting cycle is started and completed within an accounting period, the time in which financial statements are prepared. However, the most common type of accounting period is the annual period. The purpose of the accounting cycle is to ensure the accuracy of financial statements.

Step 7: Financial Statements

The closing statements provide a report for analysis of performance over the period. In addition to identifying any errors, adjusting entries may be needed for revenue and expense matching when using accrual https://accounting-services.net/quicken-estate-and-trust-fiduciary-accounting/ accounting. On March 15, 2022, A Company called JTP got $500 for its software goods and logged the transaction. The sum is credited to the Sales Revenue account and debited from the cash account.

Based on the transactions recorded as part of the accounting cycle, financial statements such as cash-flow reports, profit-and-loss statements, and balance sheets can be prepared. Prior to issuing financial statements and closing out the accounting cycle, review the reporting package. Check that all account balances are properly reconciled to the adjusted trial balance. These might include unusual or significant reconciling items, missing or incorrectly calculated accruals or deferrals, or old outstanding balances that should be written off. Reports generated include the income statement, balance sheet, cash flow statement, statement of changes in equity and notes to the financial statements.

Preparing Financial Statements

If you use accounting software, posting to the ledger is usually done automatically in the background. The ledger is a large, numbered list showing all your company’s transactions and how they affect each of your business’s individual accounts. If you need a bookkeeper to take care of all of this for you, check out Bench. We’ll Easy Payroll Software For Startups And Entrepreneurs do your bookkeeping each month, producing simple financial statements that show you the health of your business. This allows a bookkeeper to monitor account-specific financial positions and statuses. One of the most frequently referred to accounts in the general ledger is the cash account, which details the available cash.

What is Step 5 in accounting cycle?

- Step 1: Identify the Transaction.

- Step 2: Record Transactions in a Journal.

- Step 3: Post to the General Ledger.

- Step 4: Create a Trial Balance.

- Step 5: Create Financial Statements.

- Step 6: Closing the Books.

Best Practices in Accounts Receivable Management

Perhaps even more important than the initial definitions is consistent adherence across the AR team. Studies show that the longer receivables go uncollected, the less likely they are to ever be collected, either partially or in full. Provide your client with an estimate of expenses they will incur and negotiate an arrangement that would be convenient for them—which does not sacrifice your business’ profit. Without the expected funds, companies are forced to use money in their reserve that’s intended for other purposes. OneBill’s internal tax engine helped Unitas Global with huge savings and OneBill MLCM allowed them to create multiple locations to support different currencies as well international taxation.

For example, if you have an ART of 10, that means your average account receivable was collected in 36.5 days. In some cases, a company might even need to turn down a sale or oppurtunity because of cash flow problems. These four tips will surely help you stay on top of your cash flow situation and make confident financial decisions. This way, you can nip the problem in the bud and avoid any real cash flow damage. A) Make it compulsory for all new customers who may potentially be buying on credit to fill out a credit application. You can also ask repeat customers asking for an increase in their credit limit or a change to their terms to fill out another credit application to help you come to a decision.

If you are not getting paid and it is not a technical issue, chances are that there might be a larger underlying issue in your process. This is when you can leverage your sales and success teams that have direct contact with customers to help identify the root cause and find a solution. The key takeaway here is that cash collection needs to be collaborative. What this really means is that each stakeholder from different departments plays a key role in the process and that no one team is responsible for the entire process. You can use an electronic invoicing system that delivers invoice information and links directly within an email to avoid triggering spam filters with an attachment. Set up easy electronic payment portals with different online payment options that let clients pay online (by using a credit card for instance) as soon as they read your invoice.

Disregarding Relationships With Late-Paying Customers

To mitigate financial statement risk and increase operational effectiveness, consumer goods organizations are turning to modern accounting and leading best practices. Simply sticking with ‘the way it’s always been done’ is a thing of the past. Centralize, streamline, and automate end-to-end intercompany operations with global billing, payment, and automated reconciliation capabilities that provide speed and accuracy. Ignite staff efficiency and advance your business to more profitable growth.

On a company's balance sheet, accounts receivable are the money owed to that company by entities outside of the company. Account receivables are classified as current assets assuming that they are due within one calendar year or fiscal year. To record a journal entry for a sale on account, one must debit a receivable and credit a revenue account.

Pools or portfolios of accounts receivable can be sold to third parties through securitization. Include due dates, late payment fees, and other relevant information on your invoices. Accounts receivable are an important aspect of a business’s fundamental analysis.

This can be from a sale to a customer on store credit, or a subscription or installment payment that is due after goods or services have been received. When a company owes debts to its suppliers or other parties, these are accounts payable. To illustrate, imagine Company A cleans Company B’s carpets and sends a bill for the services.

What is accounts receivable management?

Knowing how to speed up the collection of accounts receivable is key to your company’s continued success. They require significant manual effort that leads to errors like inaccurate data entry, delayed invoicing, miscommunications, late payments, and ineffective follow-up. Individual phone and email outreach or physically mailing paper checks and invoices can grind collection processes to a halt. Maintaining positive cash flow is always important, but even more in times of economic volatility, company growth, or unexpected events. AR automation software can streamline AR management processes to quickly increase cash flow by automating payment collection, financial reporting, and other activities that manual collections tend to inhibit. In addition to billing and collections, another crucial part of accounts receivable management is reporting.

- With companies that may fall into patterns of late payments, consider offering terms that are feasible for them and still profitable to your company.

- For instance, if a company makes a purchase and will receive a 2% discount for paying within 10 days, while the whole payment is due within 30 days, the terms would be shown as 2/10, n/30.

- At Big Bang, we enlist a proactive approach with all of our business processes – Accounts Receivable (AR) included.

- The most effective way to improve your organization’s accounts receivable management is to automate your processes as much as possible.

- If you do, set clear credit policies ahead of time to avoid extending too much credit to some clients.

Both internal teams and customers should have easy access to real-time balances. Maintain financial orderBy analyzing a company’s accounts receivable, stakeholders and investors gain transparency into the business’s financial profitability and liquidity. AR makes it much easier to calculate an organization’s income and future profits and can impact its attractiveness to potential investors. We’ll also help you keep track of your KPIs with simple financial reports, and keep your sales and finance teams in the loop with communications, dashboards, and tasks to help everyone keep track of their receivables. Through our system, you can set up automatic, personalized reminders to send to customers when invoices are overdue.

The ability to see a snapshot of the current state of performance is critical for effective accounts receivable management. At all times, you should have easy access to accurate data on key metrics, such as days sales outstanding (DSO) or turnover ratio. Accounts receivable management is the process of monitoring and collecting payments from customers who owe your business money.

Autonomous Accounting

Kolleno AR automation tool can solve the problem of understaffing, but also seamlessly communicate with any number of clients as necessary. The growth of sales won’t be detrimental to your cash flow, Kolleno will automatically communicate with clients via several communication channels but also prepare the branded invoices, after the sale has been made. Sometimes the sales can be growing, however, the cash flow problems may reduce the survival rates of many businesses.

In B2B business transactions, especially ones that involve delayed payments, quality can become an issue. By quality, we mean not only the quality of goods or services delivered but also the quality of interactions that customers have with your organization at all touchpoints. Make quality a priority at all levels, whether it is on the shopfloor, transportation, inventory management, or the finance department. Credit transactions require constant documentation (invoicing) and payment streams. When your accounts receivable management is not streamlined, you will see breakage in the steps of AR processes.

Trends That Will Define the Future of Customer Experience In 2020 And Beyond

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue. While AR management refers to the specific processes used to gain understanding of and collect owed payments, accounts receivable is the broader set of steps it supports.

Join the 50,000 accounts receivable professionals already getting our insights, best practices, and stories every month. Providing multiple payment options allows customers to remit with their choice method, giving them fewer excuses for failing to pay. To calculate CEI, add your beginning receivables and monthly credit sales, then subtract ending total receivables. Then divide that by the sum of beginning receivables and monthly credit sales, minus ending current receivables. Most AR teams must navigate a patchwork of legacy systems, reports, spreadsheets, and tools to retrieve data and complete work.

When you extend credit, you must do so because you can reasonably expect to get paid that money eventually. Failure to properly vet customers opens the door to delayed payments, bad debts, court battles, and worse. These AI-powered solutions are tailored-made for companies of all industries and sizes. HighRadius’ RadiusOne AR Suite is built specially for mid-market CFOs which offers collections, cash reconciliation, credit, and e-invoicing app. With Artificial Intelligence all the solutions are integrated with each other so your company gets a centralized system to view all the AR processes in one place. In case of disputes, AR teams should explain each item to the customer and offer alternative solutions such as payment plans.

Inconsistent Invoicing and Collections Processes

Accounts receivable refers to your business’s outstanding invoices or money that your business is owed. In many cases, companies do not adhere to your payment terms and don’t pay their invoices on time, meaning that your accounting team has to spend time and money chasing them up. Many businesses prefer to simply outsource the accounts receivable collection process. Accounts receivable management also plays a critical role in credit management. Accounts Receivable important involves assessing the creditworthiness of customers before extending credit to them and setting credit limits to minimize the risk of non-payment.

A robust automated system permits personalized communications, which helps keep customers engaged and provides a better experience throughout their entire customer journey. This ultimately helps with customer retention, as closing entries and post happy, informed customers will keep coming back for more. And since earning new customers is six to seven times more costly than retaining a current one, excellent communication is a factor you can’t afford to ignore.

The company will then decide, based on the credit-worthiness of the applicant, as to whether they will offer goods on credit. The company might choose to offer the credit to individual customers or other businesses. However, using economies of scale, the process may differ for large and small firms. Large firms have a larger cash inflow, so they typically invest in highly skilled credit management teams and IT systems to help improve and manage the process efficiently.

This is why accounts receivable outsourcing is the best option to take for most businesses. The good news is, many of these invoice apps have set indicators that reflect when clients have opened the email, making it more difficult for them to make excuses for late payments. A company can increase their cash flow by monitoring, measuring and improving their receivable performance. However, some companies use ERP and spreadsheet to manage the data, while the others find the process extremely time consuming.

Vendors, like customers, will receive accurate, quickly generated invoices that can be accessed in a single, up-to-date portal. MAINTAIN CUSTOMER RELATIONSHIPSProviding excellent customer service by addressing any complaints or questions in a timely manner is crucial for managing solid working relationships. That would free up your time to focus on other aspects of the business.

Rules of Debits and Credits Financial Accounting

As a result, the balance sheet of the company will report assets of $19,000 and owner’s equity of $19,000. From this example, there are two reasons why Advertising Expense has to be debited. Firstly, the transaction needed a credit to Cash because the asset account was being reduced. Therefore, there had to be a debit recorded in another account, which had to be the Advertising Expense.

However, in a situation whereby the rent payment was made on May 1 for a future month, say June, the $800 debit will go to the asset account, Prepaid Rent. This means that the expense accounts only exist for a set period of time- a month, quarter, or year, and then new accounts are created for each new period. When a company spends funds (a debit), the expense account increases and the expense account decreases when funds are credited from another account into the expense account. Companies break down their expenses and revenues in their income statements. The total revenue that the company makes minus its expenses determines the net profit of the company. Expenses are recorded through one of two accounting methods- cash basis or accrual basis accounting.

Recording a sales transaction

This concept will seem strange at first, but it’s designed to be a self-checking system and to give twice as much information as a simple, single-entry system. This means that the new accounting year starts with no revenue amounts, no expense amounts, and no amount in the drawing account. While a long margin position has a debit balance, a margin account with only short positions will show a credit balance. The credit balance is the sum of the proceeds from a short sale and the required margin amount under Regulation T.

Expenses are the result of a company spending money, which reduces owners’ equity. Working from the rules established in the debits and credits chart below, we used a debit to record the money paid by your customer. A debit is always used to increase the balance of an asset account, and the cash account is an asset account. Since we deposited funds in the amount of $250, we increased the balance in the cash account with a debit of $250. All accounts must first be classified as one of the five types of accounts (accounting elements) ( asset, liability, equity, income and expense).

Income Statement

Debits represent money being paid out of a particular account; credits represent money being paid in. Most businesses these days use the double-entry method for their accounting. Under this system, your entire business is organized into individual accounts. Think of these as individual buckets full of money representing each aspect of your company. The single-entry accounting method uses just one entry with a positive or negative value, similar to balancing a personal checkbook.

Treasury Prime and Checkout.com Team to Offer Debit Card Funding - PYMNTS.com

Treasury Prime and Checkout.com Team to Offer Debit Card Funding.

Posted: Tue, 20 Jun 2023 21:56:08 GMT [source]

This is achieved by boosting revenues while keeping expenses in check. Slashing costs can help companies to make even more money from sales. Expenses also reduce your credit accounts, which means you are taxed on a lower annual revenue number. So you will generally be taxed on $20,000, not $300,000, download wave invoicing for pc and that tax bill will be lower, thanks to those expenses. Most people will use a list of accounts so they know how to record debits and credits properly. Suppose, you rent a local shop that sells apples & you make a monthly payment towards the shop’s electricity bill (by the bank).

Debit Definition: Meaning and Its Relationship to Credit

On October 1, Nick Frank opened a bank account in the name of NeatNiks using $20,000 of his own money from his personal account. Debits and credits are considered the building blocks of bookkeeping. A credit may be referred to as “CR” — these are the shortcut references. Another good idea to ensure you’re a low-risk investment is to take a look at your business credit report to understand how creditors see your company.

- This entry increases inventory (an asset account), and increases accounts payable (a liability account).

- This is particularly important for bookkeepers and accountants using double-entry accounting.

- In fact, the accuracy of everything from your net income to your accounting ratios depends on properly entering debits and credits.

- Her expertise is in personal finance and investing, and real estate.

For example, paying less on advertising reduces costs but also lowers the company’s visibility and ability to reach out to potential customers. The sum of the credits ($10,000 + $5,000 + $560) is also $15,560. You have mastered double-entry accounting — at least for this transaction. Even if your accounting software automatically downloads each liability transaction and invoice, you still should be involved with your accounts, adjusting entries when needed.