Overtime Pay: General Guidance U S. Department of Labor

If you find your mental wellness slipping because you’ve taken on more hours at work, then it’s worth limiting those hours. An indicator that working overtime isn’t right for you is if your relationships start to fail or grow distant. These are all signs that working overtime isn’t going to help you reach your financial goals alone. Overtime can be worth it if you’re trying to impress an employer or advance further in your career. This can be a risky move, however, as it can tell your employer that you’re willing to work more hours. A final reason overtime may be worth it is that you’re trying to advance your career.

BambooHR provides a one stop shop to manage data, hire talent, run payroll, and help employees thrive. Overtime rules are fairly straightforward if you stay in touch with your state DOL to ensure that you are properly compensating your employees. The basic overtime formula is (Hourly Rate) × (Overtime Multiplier) × (Number of Overtime Hours worked in a particular week). "When Is Overtime Due?"

Information about overtime from the elaws FLSA Advisor. According to the Fair Work Australia (1) an employer can request that an employee works reasonable overtime. The National Employment Standards (NES), and the Fair Work Act 2009 (Cth), both of which address what constitutes reasonable overtime, covers most employees.

- They must be treated as a salaried employee, and must be paid in set portions, at set intervals.

- The calculation method varies depending on if the bonus or commission payment is allocated by the workweek or some other frequency, e.g., monthly, quarterly, annually.

- It may begin on any day of the week and at any hour of the day and is not impacted by an employee’s pay frequency, e.g., bi-weekly, semi-monthly, monthly.

- Not only will they earn a bit more money, but the amount of money per hour is also increased.

- When it comes to deciding whether working overtime is worth the risk of taking on more taxes or not, you may be unsure how the math works.

Time off in lieu (TOIL),[1] compensatory time, or comp time is a type of work schedule arrangement that allows (or requires) workers to take time off instead of, or in addition to, receiving overtime pay. A worker may receive overtime pay plus equal time off for each hour worked on certain agreed days, such as public holidays. Federal overtime laws are based on a 40-hour workweek, but some states calculate overtime by the workday. In states that calculate overtime per workday, employers must apply the applicable overtime rate to each hour beyond what’s considered a regular workday, e.g., eight hours. The overtime rate must be at least 1.5 times the amount of your hourly pay rate. Your employer must pay you at the overtime rate for the extra hours you worked.

How to use overtime in a sentence

This might result in them advancing your career but also increasing your hours past the point you feel comfortable working. Most importantly, it won’t take away from the number of hours in which you sleep. For example, if most of your waking hours are for working, then you don’t have a lot of balance.

On August 23, 2004, President George W. Bush and the Department of Labor proposed changes to regulations governing implementation of the law. In particular, the new rules would have allowed more companies to offer flextime to their workers instead of overtime. The definition of exempt employees (ineligible for overtime) is regularly tested in the courts. A recent case is Encino Motorcars v. Navarro, which addresses the question of whether automobile dealer service advisors are eligible for overtime.

- Other exempt jobs are hourly jobs, jobs in transportation and delivery, sales, investments, and computer-related jobs.

- Or you might find our budget calculator, especially when you plan to monitor or track your expenses.

- Different workweeks may be established for different employees or groups of employees.

Note that certain states have different methods for calculating the regular rate of pay for nonexempt employees who are paid on a salary basis. A salary is intended to cover straight-time pay for a predetermined number of hours worked during the workweek. Under federal law, to calculate a nonexempt employee’s regular rate of pay, divide the weekly salary by the total number of hours worked. Most national countries have overtime labour laws designed to dissuade or prevent employers from forcing their employees to work excessively long hours (such as the situation in the textile mills in the 1920s). One common approach to regulating overtime is to require employers to pay workers at a higher hourly rate for overtime work. Companies may choose to pay workers higher overtime pay even if not obliged to do so by law, particularly if they believe that they face a backward bending supply curve of labour.

Is overtime calculated by day or week?

To calculate hourly overtime rate, multiply normal rate of pay by the company’s overtime rate. To find total overtime wages, simply multiply the amount of overtime hours worked by the calculated rate of overtime. Include any applicable special rate supplement or locality payment in the “total remuneration” and “straight time rate of pay” when What is overtime computing overtime pay under the FLSA. Compute the “hourly regular rate of pay” by dividing the “total remuneration” paid to an employee in the workweek by the number of hours in the workweek for which such compensation is paid. They must be paid for all hours worked, regardless of whose idea it was to have the employee work extra hours.

Even if an individual works two extra hours of overtime a week, that could add up to an amount that could help them slowly chip away at their debt. A few companies also choose to pay twice your hourly rate (or double-time) if you work overtime. Figuring out how much tax you owe on your overtime hours largely depends on your standard income and the number of overtime hours that you work. An employer may not retaliate[8] against an employee for filing a complaint or instituting a proceeding based on the FLSA.

Is overtime after 8 hours or 40 hours?

Note that certain states have their own methods for calculating the regular rate of pay for nonexempt employees who are paid a flat sum bonus. FLSA exempt employees, as defined in 5 U.S.C. 5541(2), who work full-time, part-time, or intermittent tours of duty are eligible for title 5 overtime pay. Employees in senior-level (SL) and scientific or professional (ST) positions who are paid under 5 U.S.C. 5376 are not excluded from the definition of "employee" in 5 U.S.C. 5541(2). However, some employers choose to use a higher rate (e.g., twice the regular hourly rate) or choose to start calculating overtime rates after 36 hours of work rather than after 40 hours per workweek. Overtime payments made to nonexempt employees are a type of payroll record and, thus, must be retained for at least three years in accordance with the FLSA. Additionally, the timesheets or other documents that show how the wages were calculated have to be saved for at least two years.

These articles and related content is not a substitute for the guidance of a lawyer (and especially for questions related to GDPR), tax, or compliance professional. When in doubt, please consult your lawyer tax, or compliance professional for counsel. Sage makes no representations or warranties of any kind, express or implied, about the completeness or accuracy of this article and related content. That said, if you work a lot of overtime or you’re already on the fringe of a tax bracket, then it may push you into another tax bracket.

Sports & Health Calculators

There are two options for calculating overtime pay for salaried employees. The state of California's overtime laws differ from federal overtime laws in many respects, and they involve overlapping statutes, regulations, and precedents that govern the compensation of employees in California. Classes of workers who are exempt from the regulation include certain types of administrative, professional, and executive employees.

Train drivers announce new week-long overtime ban in England - The Guardian

Train drivers announce new week-long overtime ban in England.

Posted: Mon, 24 Jul 2023 07:00:00 GMT [source]

To qualify as an administrative, professional, or executive employee and therefore not be entitled to overtime, three tests must be passed based on salary basis, duties, and salary level. There are many other classes of workers who may be exempt including outside salespeople, certain agricultural employees, certain live-in employees, and certain transportation employees. Employees can neither waive their FLSA protections nor abridge them by contract.

There’s a reason the government limited most businesses to operating in 48-hour workweeks. Attempting to work overtime isn’t worth it if you have a habit of overspending. Taking on extra hours won’t cause you to miss out on too much time with your family. If you’re someone who has an interest in investing but doesn’t like the idea of risking your standard income, then working overtime may also be worth it. Managing employees, time tracking, overtime, and time-off data in disparate systems is complicated.

Their requirements fit within the strategic planning framework for the organization. "Is Extra Pay Required For Weekend Or Night Work?"

Additional information about overtime pay from the elaws FLSA Advisor. Overtime does not receive a different tax rate than standard working hours. Working overtime isn’t worth it if you’re not seeing any progress towards your financial goals. One reason working overtime isn’t worth it is that you find that you’re not making any actual financial progress. You can also add up your overtime hours to determine how much money to want to risk in investment.

Overtime pay provided under title 5, United States Code, is pay for hours of work officially ordered or approved in excess of 8 hours in a day or 40 hours in an administrative workweek. Depending on the job type, the number of regular working hours might be determined by the best practices of a profession (based on the trade experience), agreements between sides, or legislation. Whatever it is, it has to fulfill national or local labor law regulations. In the United States, employers that require or allow their workers to work overtime are usually required to pay a premium rate of at least time and a half. Most workers have a fixed number of hours they work each week in their employment contract. Sometimes, they may have to or volunteer to work more than their contract requires.

In such cases, employers must use the blended rate or weighted average of all rates paid in order to calculate the overtime premium due for hours worked over 40 in the workweek. Note that the FLSA has an exception to this rule that allows employer to pay overtime via the “rate in effect.” Most states, however, do not permit this method. Overtime refers to additional pay for hours worked beyond the standard 40-hour workweek (i.e., seven consecutive 24-hour periods). Department of Labor, nonexempt employees who earn less than 35,568 dollars annually must receive overtime pay. The federal overtime provisions are contained in the Fair Labor Standards Act (FLSA).

Here are 12 Columbus-area high school field hockey players to ... - The Columbus Dispatch

Here are 12 Columbus-area high school field hockey players to ....

Posted: Tue, 22 Aug 2023 10:00:29 GMT [source]

Overtime refers to the length of time an employee works on top of their normal working week. Extra pay for working weekends or nights is a matter of agreement between the employer and the employee (or the employee's representative). The FLSA does not require extra pay for weekend or night work or double time pay. The FLSA, with some exceptions, requires bonus payments to be included as part of an employee's regular rate of pay in computing overtime. Additionally, what is considered a workweek may be defined by the employer as any consecutive seven days, with each day consisting of a 24 hour time period. While most businesses operate on a calendar week, if a business wants to run Wednesday to Tuesday for their pay period, they can.

This is also why you need to exercise caution in any situation where you may have an hourly employee working remotely. They still need to record all hours worked and receive overtime pay for the hours worked in excess of the legal maximum. Our overtime calculator is the perfect tool to help you see how much money you will earn in exchange for those extra hours at work. Fill in the information about how much your hourly rate is and the calculator will do all the rest. It will show you the rate of overtime and the total pay you can expect. It can also give you an annual wage, taking your overtime into account.

Overtime pay

Many countries design their labor laws to prevent employees from being forced to work long overtime hours. Furthermore, they usually provide regulations of overtime compensation. Under the FLSA, any non-discretionary bonuses or commission earned by a nonexempt employee must be factored into their regular rate of pay. The calculation method varies depending on if the bonus or commission payment is allocated by the workweek or some other frequency, e.g., monthly, quarterly, annually. In cases where an employee is subject to both the state and federal overtime laws, the employee is entitled to overtime according to the higher standard (i.e., the standard that will provide the higher overtime pay).

While a generalized overtime definition refers simply to those hours worked outside of the standard working schedule, overtime commonly refers concurrently to the employee’s remunerations of such work. The overtime rate of pay varies between companies and by specifics of the overtime, such as the number of overtime hours worked. The limitation on an hourly rate of overtime pay under title 5, United States Code, does not apply to overtime pay under the FLSA. Also, the maximum biweekly or annual earnings limitations on title 5 premium pay do not apply to FLSA overtime pay.

The FLSA does not require overtime pay for work on Saturdays, Sundays, holidays, or regular days of rest, unless overtime hours are worked on such days. Recall that the FLSA overtime calculation factor is 1.5 times the regular rate of pay for nonexempt employees who work more What is overtime than 40 hours per workweek. Employers can reduce their risk by adhering to each state’s overtime requirements. Sometimes nonexempt employees who are normally paid a fixed hourly rate work certain hours, usually at undesirable times, which grants them additional hourly pay.

Who Is Not Eligible for Overtime Pay?

Some people may struggle with the idea of working more hours even though they’re earning more money. As a result, you’ll have more taxes taken out of your income because you’re in a higher tax bracket. As an example, if you make $30,000 a year without overtime, then your tax bracket falls into the $9,951 to $40,545 category according to the 2021 tax season.

- If these jobs exist in your workplace, you will want to check further about overtime with the DOL.

- Ernie normally earns 15 dollars an hour for a 40-hour workweek, totalling a 600 dollar paycheck.

- Additionally, each workweek stands alone, which means that averaging hours worked over two or more workweeks is not permitted.

- Assuming you are non-exempt, you are entitled to one and one-half times your regular rate of pay for hours worked over 40 in a workweek.

The US government defines overtime as working more than 40 hours in a workweek. A common misunderstanding of how taxes and overtime work is that the wages earned during overtime are taxed at a different rate. 🙋 Make sure to use our gross to net calculator to determine how much you could take home from your total pay after the deduction of taxes. Or you might find our budget calculator, especially when you plan to monitor or track your expenses. Please note that the information provided, while authoritative, is not guaranteed for accuracy and legality. The site is read by a world-wide audience and employment laws and regulations vary from state to state and country to country.

Get pricing specific to your business

Independent contractors are not employees covered by overtime laws and so it is important to determine if a worker is an independent contractor or an employee. Certain types of other compensation, such as the following, must be included in overtime calculations. While there are several reasons working overtime is worth the extra hours, there are also some reasons it is not worth it.

Unless exempt, employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay. There is no limit in the Act on the number of hours employees aged 16 and older may work in any workweek. The FLSA does not require overtime pay for work on Saturdays, Sundays, holidays, or regular days of rest, unless overtime is worked on such days. The only time overtime pay is given on these days is when it pushes an employee’s hours past 40 hours in that workweek.

See advice specific to your business

To help relieve some of their debt, workers can choose to work a little overtime. With prices increasing and wages staying about the same, it doesn’t give Americans much room to pay off their debts. Here are a few reasons working overtime might be worth it for your situation. That’s because you’re working more for the profit of the business at the cost of your own energy, health, time with family, etc. If you were to work overtime, then you might end up with a gross income of $45,000. In terms of how much tax you’ll owe, it’s $995 plus 12% of your income after $9,950.

Assuming that overtime hours are worked, then an employee is entitled to overtime compensation. Although many employers and employees assume that overtime is calculated simply by multiplying their hourly rate by 1.5, it is not always that easy. If you have any questions about how your overtime pay rate is being calculated, you should speak with our overtime lawyers. The federal government requires employers to pay their nonexempt employees (which includes salaried employees earning less than 35,568 dollars per year) an overtime rate of 1.5 times their regular hourly rate. An employer who requires or permits an employee to work overtime is generally required to pay the employee premium pay for such overtime work. Employees covered by the Fair Labor Standards Act (FLSA) must receive overtime pay for hours worked in excess of 40 in a workweek of at least one and one-half times their regular rates of pay.

Overtime laws, attitudes toward overtime and hours of work vary greatly from country to country and between various sectors. It is common for employment contracts to include a clause that an employee may be expected to work ‘reasonable overtime’ at no extra cost to the employer and without overtime rates. In many Modern Awards, the employee’s “ordinary hours of work” refers to their typical hours of work. In some countries, special hourly rates of pay are compulsory when workers do extra hours, while in others they are not. In all but these six referenced jurisdictions, overtime is calculated only on a weekly basis.

Salary & Income Tax Calculators

Under the Fair Labor Standards Act "primarily engaged" does not necessarily mean at least half, but California wage-and-hour laws, working less than half of exempt duties automatically eliminates the overtime exemption. Employers are not required to pay exempt employees overtime but must do so for non-exempt employees. Legally, by the Fair Labor Standards Act passed in 1938, any hours worked by an employee which exceed the standard 40-hour work week define overtime hours and are subject to overtime remuneration rates. Employment Law Guide-Minimum Wage and Overtime Pay - describes the statute and regulations administered by DOL that regulate minimum wage and overtime pay. Besides all of that, let's take a look at the formal overtime definition. Overtime is the amount of time that an employee works beyond regular working hours.

It allows you to start your own business while not having to worry about feeding your family, paying your rent, or paying your mortgage. This might be a business venture that you’re exploring, a new hobby, or even a vacation. Depending on how much overtime you work, you could start to put together a nice investment.

So, an employee who works 10 hours on Monday and seven hours a day for the next four days are not considered to have worked overtime for purposes of pay in states that keep the 40 hours standard. The DOL updated both the minimum weekly standard salary level and the total annual compensation requirement for “highly compensated employees” to reflect growth since 2004 in wages and salaries. Some companies pay 2.5 times the standard rate for overtime and sometimes even more. Within the United States, the different states may have their own legislation regarding OT.

Some employers choose to pay a higher overtime rate when employees work extra hours on these particular days, but it’s not required by law. For covered, nonexempt employees, the Fair Labor Standards Act (FLSA) requires overtime pay (PDF) to be at least one and one-half times an employee's regular rate of pay after 40 hours of work in a workweek. Some exceptions apply under special circumstances to police and firefighters and to employees of hospitals and nursing homes. Assuming you are non-exempt, you are entitled to one and one-half times your regular rate of pay for hours worked over 40 in a workweek. One common mistake is that employers pay overtime based only on the employees’ hourly rate rather than their regular rate of pay, which often includes other types of compensation such as nondiscretionary bonuses. If you receive bonuses, shift differentials, or other pay in addition to your hourly rate, it is possible that your employer may not be calculating your overtime rate correctly.

- Compute the “hourly regular rate of pay” by dividing the “total remuneration” paid to an employee in the workweek by the number of hours in the workweek for which such compensation is paid.

- Overtime payments made to nonexempt employees are a type of payroll record and, thus, must be retained for at least three years in accordance with the FLSA.

- Whether managers receive money for doing extra hours may depend on whether they are exempt or non-exempt employees.

- Department of Labor, nonexempt employees who earn less than 35,568 dollars annually must receive overtime pay.

Under the FLSA, overtime pay is additional compensation (i.e., premium pay) that employers must pay to nonexempt employees who work more than 40 hours in a workweek. As previously stated, the federal rate is time and one-half the regular rate of pay, however, states that have their own laws may require daily overtime payments or double time premium pay. Overtime pay is earned when non-exempt employees work more than 40 hours in any workweek. If that happens, then they are entitled to be paid overtime at the rate of one and one-half times their regular rate of pay.

Exempt jobs – examples

This overtime calculator is a tool that finds out how much you will earn if you have to stay longer at work. All you have to do is provide some information about your hourly wages, and it will calculate the total pay you will receive this month. In some countries or companies, managers and directors do not get overtime pay. However, in most companies, they get a bonus which is typically linked to their performance or annual profits. They must receive pay for hours worked over 40 hours in a workweek at a rate not less than one and one-half their regular rate of pay.

It's known that the human organism is naturally limited and cannot sustain the same level of productivity in the 8th or 10th hour of work as at the beginning of the shift. Exempt employees are responsible for the accomplishment of a whole job. The requirements of the job are most frequently learned and negotiated through goal setting, performance development planning, and the organization's performance management process.

Unless the particular employee is exempt, any employee who works overtime receives their regular hourly rate plus 50% (often known as time and a half) during those extra hours. For employees with rates of basic pay equal to or less than the rate of basic pay for GS-10, step 1, the overtime hourly rate is the employee's hourly rate of basic pay multiplied by 1.5. According to the FLSA rules (Fair Labor Standards Act), nights, weekends, or holidays do not require to be paid as overtime (unless the worker crosses the regular hours' threshold). Many employers state additions to regular wages for hours done on evenings, weekends, or holidays on their own.

Navigating regulatory complexity for online travel agencies

Content

The platform includes tools for catalog management, budgeting, document handling, sales tracking, and financial management. OTRAMS is a versatile, cloud-based solution ideal for all-sized travel businesses, allowing efficient handling of bookings and operations from a multi-platform accessible console. It covers various travel facets like hotel, flight, car rental, and MICE requests. Additionally, Tourwriter integrates Customer Relationship Management (CRM) tools and commission management capabilities. This all-inclusive functionality allows tour operators to streamline their operations while delivering exceptional customer experiences.

Like your company’s assets, liabilities are broken down into current liabilities and non current liabilities. Current liabilities are due within twelve months and include short term financial obligations and accounts payable. Common examples include your business bank account and cash equivalents, marketable securities, accounts receivable or commission receivable, and any prepaid expenses. The balance sheet equation, also known as the basic accounting equation, outlines that a company’s total assets must equal total liabilities plus shareholder equity. The automated processing tools are well-designed to automatically record and compute the accounting results as and when desired.

Cash Receipt Journal

If your business were to be sued, the courts might come after your personal assets if they see the comingling of business and personal expenses. This might be on financial and legal expenses, commissions to travel agents, and any other travel agency accounting operating expenses you expect to incur. Creating your agency’s travel website through these platforms can benefit in so many more ways than just adequate and timely recording and assessment of the financial aspect of the business.

Setting clear tax expectations and obligations is in the best interest of businesses, localities, and states. It’s good for businesses because it helps them comply with state and local tax requirements. It’s good for state and local governments because the easier it is for businesses to comply with tax requirements, the more tax revenue state and local governments will receive. https://www.bookstime.com/bookkeeping-services The platform allows customization of agent settings, management of offline services, and generates client-specific reports. Further features include social media integration, advanced map views, and extensive online training resources for system familiarization. TechnoHeaven stands as a leading Travel Portal Development Company, providing comprehensive Travel Portal Solutions.

Bookkeeping Services for Travel Agency

Accounting involves recording, classification and summarizing the accounting information directed toward the determination of financial strength and weakness of a travel agency. The Wayfair decision revolutionized sales tax, but it was merely the tipping point for the online travel agency industry. To a certain extent, marketplace facilitator laws have proven much more impactful. Features include multilingual support, social media integration, SSL protection, and a Channel Manager to connect with online travel agencies. Pricing is monthly, and support is provided through online forums and phone assistance.

The FASB recently introduced new revenue recognition guidelines, requiring businesses to only report revenue on the income statement when the performance obligation is satisfied. This means that if a client pays you upfront for a trip in two months, you cannot report that revenue until they have taken their trip, leading to a deferred revenue account on the balance sheet. When you start a travel agency or travel agent, you need to keep accurate accounting & financial records for your business with bookkeeping for Travel Agency.

4 4 Compute a Predetermined Overhead Rate and Apply Overhead to Production Principles of Accounting, Volume 2: Managerial Accounting

The estimated or budgeted overhead is the amount of overhead determined during the budgeting process and consists of manufacturing costs but, as you have learned, excludes direct materials and direct labor. Examples of manufacturing overhead costs include indirect materials, indirect labor, manufacturing utilities, and manufacturing equipment depreciation. Another way to view it is overhead costs are those production costs that are not categorized as direct materials or direct labor.

- For these reasons, most companies use predetermined overhead rates rather than actual overhead rates in their cost accounting systems.

- A number of possible allocation bases are available for the denominator, such as direct labor hours, direct labor dollars, and machine hours.

- As explained previously, the overhead is allocated to the individual jobs at the predetermined overhead rate of $2.50 per direct labor dollar when the jobs are complete.

- So, predetermined overhead rates are an important tool for the organization to assess their performances quickly and take corrective measures.

- The business world is dynamic, and the production environment is getting complex day by day.

- Predetermined Overhead Rate Calculators are essential tools for cost accountants, financial analysts, and business managers.

- Once the total overheads are estimated, the organization needs to identify the base unit used for allocating overheads.

To avoid such fluctuations, actual overhead rates could be computed on an annual or less-frequent basis. However, if the overhead rate is computed annually based on the actual costs and activity for the year, the manufacturing overhead assigned to any particular job would not be known until the end of the year. For example, the cost of Job 2B47 at Yost Precision Machining would not be known until the end of the year, even though the job will be completed and shipped to the customer in March. For these reasons, most companies use predetermined overhead rates rather than actual overhead rates in their cost accounting systems.

Estimated Total Manufacturing Overhead Costs

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. From the above list, salaries of floor managers, factory rent, depreciation and property tax form part of manufacturing overhead.

Examples can include labor hours incurred, labor costs paid, amounts of materials used in production, units produced, or any other activity that has a cause-and-effect relationship with incurred costs. The predetermined overhead rate is based on anticipation and certain historical data. The person involved in preparing and finalizing overhead rates must have an eye for detail and an in-depth understanding of products and the manufacturing process within the organization. Also, any change in the product line, raw material, or any deviation from previous processes must be taken into consideration before the finalization of predetermined overhead rates.

Calculation of Predetermined Overhead and Total Cost under Traditional Allocation

Therefore, the predetermined overhead rate of TYC Ltd for the upcoming year is expected to be $320 per hour. There are several concerns with using a predetermined overhead rate, which include are noted below. Following are some of the disadvantages of using a predetermined overhead rate. Overheads have been absorbed in the product cost traditionally using machine and labour hours. However, modern absorption requires the use of multiple bases to enhance the accuracy of the process.

Reh Faculty Achievements - Clarkson University News

Reh Faculty Achievements.

Posted: Fri, 22 Sep 2023 13:17:32 GMT [source]

For example, the recipe for shea butter has easily identifiable quantities of shea nuts and other ingredients. Based on the manufacturing process, it is also easy to determine the direct labor cost. But determining the exact overhead costs is not easy, as the cost of electricity needed https://www.bookstime.com/ to dry, crush, and roast the nuts changes depending on the moisture content of the nuts upon arrival. Cost accountants want to be able to estimate and allocate overhead costs like rent, utilities, and property taxes to the production processes that use these expenses indirectly.

Examples of Predetermined Overhead Rate

This activity base is often direct labor hours, direct labor costs, or machine hours. Once a company determines the overhead rate, it determines the overhead rate per unit and adds the overhead per unit cost to the direct material and direct labor costs for the product to find the total cost. If an actual rate is computed monthly or quarterly, seasonal factors in overhead costs or in the activity base can produce fluctuations in the overhead rate. For example, the costs of predetermined overhead rate heating and cooling a factory in Illinois will be highest in the winter and summer months and lowest in the spring and fall. If the overhead rate is recomputed at the end of each month or each quarter based on actual costs and activity, the overhead rate would go up in the winter and summer and down in the spring and fall. As a result, two identical jobs, one completed in the winter and one completed in the spring, would be assigned different manufacturing overhead costs.

It’s useful in cost accounting as product costing can only be obtained once overheads are absorbed in the cost of the product. Overhead costs are then allocated to production according to the use of that activity, such as the number of machine setups needed. In contrast, the traditional allocation method commonly uses cost drivers, such as direct labor or machine hours, as the single activity. There are concerns that the rate may not be accurate, as it is based on estimates rather than actual data. In addition, changes in prices and industry trends can make historical data an unreliable predictor of future overhead costs. Finally, using a predetermined overhead rate can result in inaccurate decision-making if the rate is significantly different from the actual overhead cost.

6 1 Calculate Predetermined Overhead and Total Cost under the Traditional Allocation Method Principles of Accounting, Volume 2: Managerial Accounting

Often, the actual overhead costs experienced in the coming period are higher or lower than those budgeted when the estimated overhead rate or rates were determined. At this point, do not be concerned about the accuracy of the future financial statements that will be created using these estimated overhead allocation rates. You will learn in Determine and Disposed of Underapplied or Overapplied Overhead how to adjust for the difference between the allocated amount and the actual amount. At the start of a period, organizations typically calculate the https://www.bookstime.com/ by dividing the estimated total manufacturing overhead cost by the estimated total base units.

Savings Account and CD Rates Today Savings Rates Vs CD Rates - Business Insider

Savings Account and CD Rates Today Savings Rates Vs CD Rates.

Posted: Sun, 08 Oct 2023 11:00:00 GMT [source]

The predetermined rate of overheads can be calculated by putting the values in the above formula. The use of such a rate enables an enterprise to determine the approximate total cost of each job when completed. In recent years increased automation in manufacturing operations has resulted in a trend towards machine hours as the activity base in the calculation. Let’s say there is a company, ABC Ltd., which uses Labour Hours as the base for allocating Overheads. In the coming year, the company expects the total overheads to be $150,000 and expects that there will be 3,000 direct labor hours worked. They then utilize this predetermined overhead rate for product pricing, contract bidding, and resource allocation within the organization based on each department’s utilization of resources.

Step 3 of 3

So, to absorb the indirect cost in the product cost predetermined overhead rate is determined. It’s important to note that actual overheads are not used in the calculation process. It’s because actual overheads vary from period to period based on seasonal variation and changes in the external environment.

- It is very important to understand the purpose for which the predetermined overhead is being used.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- Knowing the total and component costs of the product is necessary for price setting and for measuring the efficiency and effectiveness of the organization.

- They then utilize this predetermined overhead rate for product pricing, contract bidding, and resource allocation within the organization based on each department’s utilization of resources.

- This is related to an activity rate which is a similar calculation used in Activity-based costing.

- Estimating overhead costs is difficult because many costs fluctuate significantly from when the overhead allocation rate is established to when its actual application occurs during the production process.

- The first step is to identify the total overheads identification for the target period.

This allocation can come in the form of the traditional overhead allocation method or activity-based costing.. Let us take the example of ort GHJ Ltd which has prepared the budget for next year. The company estimates predetermined overhead rate a gross profit of $100 million on total estimated revenue of $250 million. As per the budget, direct labor cost and raw material cost for the period is expected to be $40 million and $60 million respectively.

Example of Predetermined Overhead Rate

So, if you wanted to determine the indirect costs for a week, you would total up your weekly indirect or overhead costs. You would then take the measurement of what goes into production for the same period. So, if you were to measure the total direct labor cost for the week, the denominator would be the total weekly cost of direct labor for production that week. Finally, you would divide the indirect costs by the allocation measure to achieve how much in overhead costs for every dollar spent on direct labor for the week.

- The estimated or budgeted overhead is the amount of overhead determined during the budgeting process and consists of manufacturing costs but, as you have learned, excludes direct materials and direct labor.

- Suppose the budgeted cost of overheads for the departmental store amounts to $20,000 per month, and the budgeted level of production is 10,000 per month.

- Finally, you would divide the indirect costs by the allocation measure to achieve how much in overhead costs for every dollar spent on direct labor for the week.

- However, modern absorption requires the use of multiple bases to enhance the accuracy of the process.

- The overhead used in the allocation is an estimate due to the timing considerations already discussed.

- It’s because actual overheads vary from period to period based on seasonal variation and changes in the external environment.

Once the total overheads are estimated, the organization needs to identify the base unit used for allocating overheads. The base unit can be the number of units produced; labor hours worked, machine hours utilized, or any other base depending on the type of business. The base unit identification is critical for the accurate allocation, which ultimately helps identify the department-wise performance and any issues. Hence, the overhead incurred in the actual production process will differ from this estimate.

QuickBooks Online Review 2023: Features, pricing, and more

Content

Employees proactively search for scams and frauds that might impact QuickBooks customers. Multi-factor authentication is required, and the company safeguards your data using AES-256 (Advanced Encryption Standard with 256-bit keys), which ensures the highest level of cryptographic security. Intuit also participates in established partnerships with multiple security organizations and alliances to help make sure that your data is protected by the best methods available. Intuit reports that 94% of accounting professionals feel QuickBooks Online saves them time and thus saves their clients’ money. Watching tutorials, reading support pages or consulting experts for advice are all great options to learn how to use QuickBooks Online for your business.

- With QuickBooks Online, you can send, track and file 1099 forms for independent contractors.

- All accounting features can be conveniently accessed on one main dashboard, making bookkeeping more fluid and efficient.

- When it comes to features and integrations, QuickBooks Online and Xero are pretty evenly matched.

- Furthermore, users can access a searchable knowledge base of articles, videos and guides, as well as a user community and online training classes.

- We looked at 19 accounting software companies with specialized products for small businesses before choosing our top five software options.

- I asked about account reconciliations and got a brief explanation as well as links to tutorials and options to dive deeper into the topic.

From the dashboard, a cash flow formatting snapshot shows you both where your business stands now and where it likely will stand financially several months to a year down the road. QuickBooks Online customers can also set up automatic recurring invoices, send invoice reminders and accept tips via the invoice, though only QuickBooks Online Advanced customers can send batched invoices. The Sales Tax Center in QuickBooks Online lets you track the appropriate sales tax amounts for all purchases made. The Sales Tax Owed option tracks all relevant sales along with taxable sales, and the amount of tax assessed.

QuickBooks Commerce vs. Fishbowl Inventory Comparison:

QuickBooks also offers a separate product called QuickBooks Self-Employed. This tier is priced at $7.50 per month for the first three months, doubling to $15 per month thereafter. Each version of QuickBooks includes a 30-day free trial unless you opt into the half-priced first three months. Accounting software reduces the amount of time spent on data entry by allowing users to sync their business bank accounts and credit cards with the software. Once synced, transactions will flow into the accounting software, which can be categorized into various accounts.

Later, when reconciling your books, you’ll be able to review these transactions in the For Review tab within the Banking menu. Many third-party app integrations are available, such as Gusto, G Suite, and more. A unique feature of FreshBooks is that invoices can be highly stylized and customized for a professional look and feel.

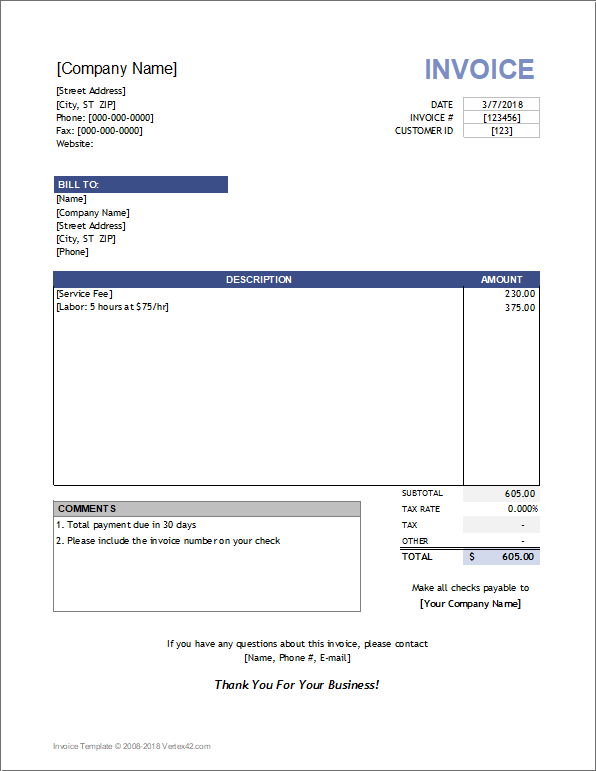

Intuit - Quickbooks

Creating professional invoices could be the difference between your business getting paid and your invoice being ignored. For this reason, we appreciate how thoroughly QuickBooks handles invoice creation. Its invoicing features are more robust than those of many competitors we reviewed.

- The solution is ideal for business owners who’d like to step away from day-to-day bookkeeping tasks and outsource them elsewhere to save time.

- This tier is priced at $7.50 per month for the first three months, doubling to $15 per month thereafter.

- If you aren’t sure about the product, you can give it a 30-day test run with 100% capabilities of the Simple Start Plan to see if it meets your needs.

- It also gives you bill management and collects employee time for invoices to add them for proper billing.

- Other popular merchant processors don’t require this, making collecting payments more difficult.

- I didn't want to because I know QB has never done an update that works.

Intuit has also added a New Transaction tab for easy expense entry, and now includes a Filter option along with a Batch Actions tab. As an added convenience, qbo login all vendor information is managed from the Expenses screen. Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews.

Inventory management

I’ve cut my month end closing time down considerably; I am doing more in less time. An added bonus is that my clients are ecstatic about the client portal, the ease of communication, and the beautiful and impactful reporting package. Access a best-in-class cloud-connected ecosystem of accounting, business and industry-specific applications. Build efficient, productive relationships by collaborating with your team and clients in one secure environment. Increase your sales and keep track of every unit with this top rated inventory software.

IRS says Microsoft may owe more than $29 billion in back taxes

By mid-May, more than 142 million taxpayers had filed returns, according to the IRS. But the agency expected about 168 million returns, which means more than 25 million taxpayers were waiting beyond the April 18 deadline to file. As a small business owner with https://quickbooks-payroll.org/bookkeeping-for-nonprofits-best-practices-tips/ employees, you must withhold certain taxes from your employees’ wages. So how do you go about the actual process of doing your tax return? Filling out this year’s income taxes doesn’t have to be confusing—here we’ve broken it down into 7 simple steps.

Those people have until Feb. 24 to file various individual and business tax returns. Taxpayers potentially affected by recent storms should visit the disaster relief page on IRS.gov for the latest information. You probably already know that taxes are figured based on your taxable income bracket. Each bracket of income is taxed at a different rate, so determining which one you fall into will help you better plan for this year’s federal income tax filing. Regardless of whether you file an extension or not, those who owe federal income taxes are required to pay by April 18th, 2024, or else face interest and penalty fees. That means a lot of new business owners are facing their first filing season.

Featured in October

You may want to consider using tax software to complete your return. Remember that keeping track of your expenses during the current year will make it easier for you to complete the various Schedules and file your taxes accurately. However, if you plan on filling out your tax forms manually, you can access all IRS forms, instructions, and publications on IRS.gov The address for mailing your tax return is listed in the Form 1040 instructions. The downside of this option is that it can take much longer to process your return.

Highest tax based on three bases, in addition to the Metropolitan transportation business tax (MTA surcharge), if applicable. Information on this page relates to a tax year that began on or after January 1, 2022, and before January 1, 2023. A Limited Liability Company (LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your state if you are interested in starting a Limited Liability Company. Accounting records include things like your income statements (also known as profit and loss statements), balance sheets, and payroll documents. The Self-Employment Tax page has more information on Social Security and Medicare taxes.

What Is IRS Free File?

Goff also said that the $28.9 billion sought by the IRS could be reduced by up to $10 billion because of taxes paid as a result of a 2017 tax law signed by then-President Donald Trump. The IRS has also looked at other affiliates, including A Guide to Nonprofit Accounting for Non-Accountants one that involved retail sales in Asia, according to court documents. Part of the long-running IRS investigation centered on how Microsoft structured a manufacturing facility starting in 2005 in the U.S. territory of Puerto Rico.

If you haven't filed and paid your tax, use our penalty and interest calculator to calculate your late filing and late payment penalties and interest. In order to report your Social Security and Medicare taxes, you must file Schedule SE (Form 1040 or 1040-SR ), Self-Employment TaxPDF. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare taxes you should have paid during the year. The Instructions for Schedule SEPDF may be helpful in filing out the form. Estimated tax is the method used to pay Social Security and Medicare taxes and income tax, because you do not have an employer withholding these taxes for you.

Resources for Your Growing Business

The online tax preparation software partners are part of the Free File Alliance, which coordinates with the IRS to provide free electronic federal tax preparation and filing to you. This non-profit, public-private partnership is dedicated to helping millions of people prepare and file their federal taxes online for free. IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software.

- Information to help you resolve the final tax issues of a deceased taxpayer and their estate.

- While it shouldn’t take long to actually file your taxes, give yourself a week or two before the tax deadlines to make sure you have all your records in order.

- You’ll also use the tax tables on the form to calculate your tax liability.

- Our standard delivery time for business taxes is 7 days from submission, but you can have us expedite your taxes by selecting our next day or 2-day options.

- You can prepare and file up to 50 W-2s at a time, free of charge, at Using SSA’s online W-2 filing, you can also print out all the copies of the W-2 for your employees, state taxing agencies, and others.

Form 11-C - Use Form 11-C, Occupational Tax and Registration Return for Wagering, to register for any wagering activity and to pay the federal occupational tax on wagering. Generally, you must pay SE tax and file Schedule SE (Form 1040 or 1040-SR) if either of the following applies. If you're using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR for 15 months, an insane cash back rate of up to 5%, and all somehow for no annual fee. Sales tax gets charged on the revenue you raise from selling taxable goods or services, regardless of whether you make a profit. For information regarding state-level requirements for starting and operating a business, please refer to your state's website.

Who needs to use Form 1040?

Stay updated on the latest products and services anytime anywhere. If you are a retail dealer, wholesale dealer, or cigarette stamping agent and owe the cigarette floor tax, you must file a return and pay the tax due by November 20, 2023. You can file an extended or late return with IRS Free File through October 16 at midnight ET. U.S. citizens or resident aliens abroad have an automatic 2-month extension to file. An Employer Identification Number (EIN), also known as a federal tax identification number, is used to identify tax reports to the IRS. If you have a simple tax return, you can file for free yourself with TurboTax Free Edition, or you can file with TurboTax Live Assisted Basic or TurboTax Live Full Service Basic at the listed price.

- Ensuring the accuracy of each step will help you make the most of this year’s tax filing process, saving you money or possibly netting you a refund.

- Each state may use different regulations, you should check with your state if you are interested in starting a Limited Liability Company.

- The exact process for each type of small business tax differs, so there's no one-size-fits-all procedure to follow.

- While you can’t usually deduct the cost of commuting from home to work and back again, you can claim deductions based on mileage or on actual car expenses (gas, repairs, insurance, registration, etc.).

- Every small business owner should have a separate bank account and credit card for their business.

Social Media Changed How Brands Talk to Us, but Are the Jokes Wearing Thin? The New York Times

If you’re like most modern business owners, odds are you didn’t become one so that you could practice professional-level bookkeeping. Outsourcing the work to a seasoned bookkeeper can allow you to focus on your business plan and growth. Bookkeeping is just one facet of doing business and keeping accurate financial records. With well-managed bookkeeping, your business can https://www.wave-accounting.net/accounting-for-in-kind-donations-to-nonprofits/ closely monitor its financial capabilities and journey toward heightened profits, breakthrough growth, and deserved success. This means recording transactions and saving bills, invoices and receipts so you have all the data you need to run reports. Accounting software makes it easy to store these documents and reference them in case of an accounting error or audit.

While any competent employee can handle bookkeeping, accounting is typically handled by a licensed professional. It also includes more advanced tasks such as the preparation of yearly statements, required quarterly reporting and tax materials. Keep in mind that in most cases, you can edit the chart of accounts to better suit your business. It’s also a good idea to become familiar with the accounts included in your chart of accounts, The Basics of Nonprofit Bookkeeping which will make it much easier when you begin to enter financial transactions. This guide is designed to simplify the bookkeeping process for you, providing you with the basics from proper setup of all of your accounts to why it’s important to record transactions promptly. Owning property abroad, whether it’s real estate, bank accounts, or other assets, can have tax implications that U.S. citizens must be aware of and comply with.

Revenue vs. Profit: The Difference & Why It Matters

Whichever accounting method you choose, the best way to make sure you’re dotting your i’s and crossing your t’s is to maintain order in the way you manage your bookkeeping. From practicing calculations to understanding your company’s tax obligations, learning the discipline of accounting can only help your business grow better. Business accounting might seem like a daunting mountain to climb, but it’s a journey well worth it. Accounting helps you see the entire picture of your company and can influence important business and financial decisions. Whomever you choose, be sure to read plenty of reviews and testimonials about your potential accountant.

- You may be hoping for the best and have a few college courses in your back pocket.

- As a sole proprietor, freelancer, or small business owner, you can choose between using a traditional hand-written ledger, spreadsheet software, or accounting software.

- Reviewing tax reports can help you maximize tax deductions for your business.

- The BLS reports the median annual salary for bookkeepers as $45,560.

- You can apply for a business credit card using your personal credit score and income; business credit is not a requirement.

- It makes sure that financial statements are a realistic overview of revenues and liabilities.

Sometimes this extra data can help the public image of a company or clarify the value of a company's investments. It makes sure that you can compare financial reporting across a company. Say you're comparing two departments, but they record the same transactions in different ways. Your revenue is the total amount of money you collect in exchange for your goods or services before any expenses are taken out. Sometimes a business will do this research and work as part of an initial business plan.

Accounts Receivable & Accounts Payable

In the cash method of accounting, you record the transaction only when the money has actually changed hands. So, even though you received an invoice in January, you’d record the expense as a cash transaction in February, on the date that it was paid. Proper bookkeeping also allows you to determine the areas within your company that could benefit from improvements.

Cash covers both physical and electronic money (such as transferred funds). Some businesses start off by using the cash basis and as they grow, they shift to the accrual basis of accounting. Equity refers to the ownership of the business owners and investors in the company. In the Balance Sheet, the equity accounts cover all the claims they have over the company. When hiring external team members, keep in mind that some of the responsibility still falls to you as the proprietor.

Choose an accounting method

Then you can generate financial reports to see which customers generate the most revenue. One of the first decisions you have to make when setting up your bookkeeping system is whether or not to use a cash or accrual accounting system. If you are operating a small, one-person business from home or even a larger consulting practice from a one-person office, you might want to stick with cash accounting. If you enjoy organization and numbers and have experience with bookkeeping, starting your own business offering this service might be a smart career choice.

Seller Ledger Bookkeeping Launches for eBay Streamlined Features Geared Towards Sellers

Microsoft Office 2010 and Office 365 are examples of full software suites that can be used to perform a wide range of accounting tasks either on your computer or in the cloud. There's a total for billable hours tracked during the current month, along with links to what's new this week (like uncategorized expenses and new sales). Most items on this page, in fact, contain links to underlying data. You can, for example, add invoices and accounts, see the transactions behind the charts, and track time.

As long as you can access your web browser, you’ll have the latest version of the software running at full-strength for your eBay store. Many users love online accounting software for its ease of use, as you don’t require to have an accounting background to operate one. If you're already using an ecommerce app to track sales on eBay, you'll want to find accounting software that easily pairs with your current app. Xero and QuickBooks Online tend to integrate with the most apps—Xero has over 1,000 integrations and QuickBooks is nearing 1,000.

Do I really need accounting software if I just have a small eBay store?

New bills can be created for monitoring in Xero directly from the dashboard, as well. The software processes all sales, refunds, fees, and taxes comprising your payout, generating a concise summary entry posted to your chosen software. This corresponds exactly with the deposit you received in your bank, making reconciliation of your balance sheet and the entire bookkeeping for ebay sellers month's sales swift and hassle-free. This allows for effortless categorization of income and expenses, as well as generating financial reports, making effective financial management a breeze. When making your decision, take into account factors like inventory management, third-party integrations, pricing, and specialized features designed for your requirements.

The Top 50 SaaS CEOs of 2023 - The Software Report

The Top 50 SaaS CEOs of 2023.

Posted: Tue, 24 Oct 2023 17:00:35 GMT [source]

This probably wouldn’t happen to you anytime soon, but it does show that even small mistakes in Excel spreadsheets can have huge consequences over time. The reason for this is that in order to thrive, you will need the functionalities and accuracy that these systems provide. A well-known example of where spreadsheets went badly for one business was JP Morgan, who in lost £5 billion in revenue - all due to an error in Excel. In reality, integration is anything but easy, especially in the beginning. What I like the most is the integrations and the forms it generates such as Profits and Losses.

Conclusion: The Best accounting software solution for eBay sellers?

Next, consider whether the software offers robust invoicing capabilities. Double-entry accounting is a system where every transaction affects the balance sheets of at least two accounts—one account is debited and another is credited. Inventory management is another crucial component for eBay businesses.

- While much of your daily accounting work probably involves paying bills, sending invoices, and recording payments, you also need to keep a close eye on your bank and credit card activity.

- As is the case with any retail business, inventory is the lifeblood of your eBay business.

- You can examine these reports in Xero, where your sales, refunds, and fees are neatly displayed in your profit and loss reports.

- For Linux users, alternatives to Microsoft Office exist that can meet your office software needs.

- Xero Tax handles sales tax calculations and reporting automatically.

For businesses that operate for an extended period of time, this means you’ll have increased potential of analyzing historical trends compared to the 3-months that eBay limits you to. Entering data manually could be doable if you only make a few sales a month. Otherwise, you'll want to look for software that directly connects to your seller account, imports finances, and organizes data without much action from you. At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Zoho Books

They’d be happy to provide a list of

free the best accounting software for eBay sellers recommendations

that meet your exact requirements. In other words, while we think the seven accounting software we reviewed here are the best options for most sellers, we recommend looking into each provider’s specifics to find the one for you. Nearly all of these providers offer free trials, and we strongly recommend test-driving software before committing to one accounting solution. FreshBooks also offers freelance features in the same vein as QuickBooks and Xero. You can use the software to track sales taxes, stay on top of your profits, and create crucial tax forms at the end of the year.

Since it isn’t as popular as Xero, QuickBooks, or FreshBooks, it doesn’t sync with as many ecommerce or inventory apps—you’ll have to manually input more financial data to keep your books up to date. These record templates vary in complexity, so you need to understand the differences before you go with one accounting service or another. Some, such as Patriot Software Accounting Premium, simply let you maintain descriptive product records. They ask how many of each product you have in inventory when you create a record and at what point you should be alerted to reorder. Then they actively track inventory levels, which provides insights on selling patterns and keeps you from running low. Wave is for sole proprietors and freelancers who need an online accounting service and may want a little room to grow.

BRAND NEW UNUSED SAGE MAS500 Active Planner Version 7.45. Software + Docs On CDOpens in a new window or tab

And you can't choose from a list of the time entries you've created as items—you can only enter notes describing the entry and provide the rate each time. Editors' Choice FreshBooks includes a timer, and it also allows contractor access for time tracking within projects, as well as other team collaboration tools. Why fumble with multiple tables and reports for multiple seller accounts? With MyCostPro, You can download sales data for all of your eBay accounts into a single sortable table. All of your profit and loss and reporting information will include data from all of your accounts in one convenient place! We offer the ability to incorporate additional accounts at a substantially discounted rate compared to separate subscriptions.

Connect to eBay Managed Payments with QuickBooks Online

If you make less than $50K USD a year, you qualify for Zoho Books' free plan. All online accounting services simplify the accounting process, but there will undoubtedly be times when you have questions. Some apps also provide context-sensitive help along the way and a searchable database of support articles. It's best used by small businesses that would make use of the lion's share of its well-integrated features, and that need more powerful reporting options than many of its competitors offer.

- 10 Minute Accounts is accounting software designed for eBay sellers.

- Saving time is one of the benefits of using accounting software for your ecommerce business.

- QuickBooks and Xero are both accounting software, but they differ in terms of features, pricing, and user interface.

- Then they actively track inventory levels, which provides insights on selling patterns and keeps you from running low.

- The best banks for eBay seller payments may vary depending on your location and specific needs.

Sure the bins don’t need emptying, but a lot of other plates remain spinning in the air - particularly when it comes to ecommerce businesses. A2X ensures that eBay sellers get all the information they need in an organized, clean and efficient way, at the touch of a button. Ordoro doesn’t offer demand forecasting, manufacturing inventory features or enterprise-specific resources. There’s also a free plan available, but it’s very limited in features. More than three decades after its creation, accounting professionals worldwide still rely heavily on Microsoft Excel.

Accounting Small Business Software Finance Accounts Bookkeeping Tax Filing IRSOpens in a new window or tab

This interactivity makes the dashboard very effective and timely—one of the best I've seen. QuickBooks Online is best for eBay sellers who need a feature-rich accounting solution to manage income and expenses, calculate taxes, and forecast profits. Real-time reports provide insights into sales, profits, inventory demand, and more.

QuickBooks vs. Xero: Which Is Best in 2023? - Business News Daily

QuickBooks vs. Xero: Which Is Best in 2023?.

Posted: Thu, 31 Aug 2023 14:35:25 GMT [source]

Then there’s using it for different channels - you can’t integrate a spreadsheet for automatic updates, or add apps that optimize certain aspects of your books. There’s nothing wrong with using spreadsheets to help run your business, but spreadsheets rely on manual data entry and can be outgrown very quickly. Now that you’ve had an all-round introduction to accounting, bookkeeping and ecommerce challenges, let’s get stuck into eBay accounting specifically. Hopefully not, because as much as there are obstacles to overcome, there are plenty of tools to help you do just that. Before we get to those, there are a few terms you should be aware of as you venture into the world of ecommerce and eBay accounting. You (or your accountant) need to know where to find the missing information, and which tools can automate that time-consuming process for you.

Intuit QuickBooks Desktop Premier 2020 Accounting Software for WindowsOpens in a new window or tab

If you're searching for accounting software that's user-friendly, full of smart features, and scales with your business, Quickbooks is a great option. If you're traveling and have numerous related expenses on the road, for example, bookkeeping for ebay sellers then you can often take pictures of receipts with your smartphone. Some accounting services attach these receipts to a manually entered expense form. Once you have completed an invoice, for example, you have several options.

Check out why they are our picks for eBay sellers and what the experts say in the blog above. The information in every settlement, the movement of your inventory, and naturally, your cash flow - past, present and future? Getting that into a functional spreadsheet is challenging to say the least. Keeping your books updated is not just about pleasing the taxman. It’s about regularly making informed decisions about the future of your business. Bookkeeping is an accounting practice whereby information is recorded neatly and organized accessibly.

Let's get your eBay business Automated!

Webgility reduces this concern by automatically and accurately calculating and validating sales tax based on location for each order. Afterward, all orders are posted to QuickBooks Online with the proper sales tax applied, meaning retailers can rest assured of tax compliance regardless of sales channels. Zoho Inventory is completely free if you fill 50 or fewer orders a month. You'll get 50 shipping labels and can send 50 invoices too, and you can manage inventory stored at one warehouse. Zoho Inventory isn't a thorough accounting solution, but it syncs with Zoho Books, which tracks expenses, reconciles bank accounts, and lets you send multilingual invoices.

- And because knowledge is power, Kashoo offers a variety of critical reports.

- FreshBooks offers standard reports that can be modified by eBay sellers to fit their needs.

- However, it’s essential to follow security best practices to protect your financial data.

- Check out why they are our picks for eBay sellers and what the experts say in the blog above.

Sellers can access their financial statements and sales reports in their eBay Seller Hub or by using eBay’s reporting tools. EBay sellers should avoid violating eBay’s policies, engaging in unethical practices, misrepresenting products, or providing poor customer service. After trying out dozens of accounting software, we found that the best eBay accounting software options available on the market are Zoho Books, Sage, Wave, and Xero. Merchants can generate reports such as income statements, balance sheets, and sales tax to keep tabs on the financial health of their eBay business. This accounting software integrates with Stripe for those eBay sellers who also sell merchandise in person.