It encompasses a variety of day-to-day tasks, including basic data entry, categorizing transactions, managing accounts receivable and running payroll. For an additional fee, Bench offers catch-up bookkeeping if you’re behind on your financials. It also offers limited support for business taxes by preparing a year-end financial package for your CPA. You can pay for additional tax services by adding BenchTax to your bookkeeping services. Outsourcing your projects to experienced tax pros or CPAs is one of the best ways to ensure that your business’s accounting needs are being met. They can help you with all aspects of accounting including cash flow management, business planning and budgeting, and tax returns for small businesses.

Cost comparison is a useful tool when choosing a small business accountant. Ask for recommendations from your business network or professional associations. People who have used an accountant’s services can give you firsthand feedback on their performance. Ensure they have relevant experience in managing small business finances and are updated with current financial regulations and technologies. You don’t have to worry about errors in your bookkeeping, missed tax deadlines, or financial decisions made in the dark.

Why You Can Trust Forbes Advisor Small Business

Under this method, you record income when you make a sale and expenses when you incur them. This is irrespective of whether you received or paid cash for the product or service. You must use a double-entry accounting system and record two entries for every transaction.

This will allow you to make better financial decisions for the long-term health of your company. Remember that a CPA is also very well paid, and although rates vary, they are typically much higher than an accountant’s. So, weigh your problems with what may happen if you don’t get professional help. If you do, and the IRS wants to take a look at your books, then you may need a CPA.

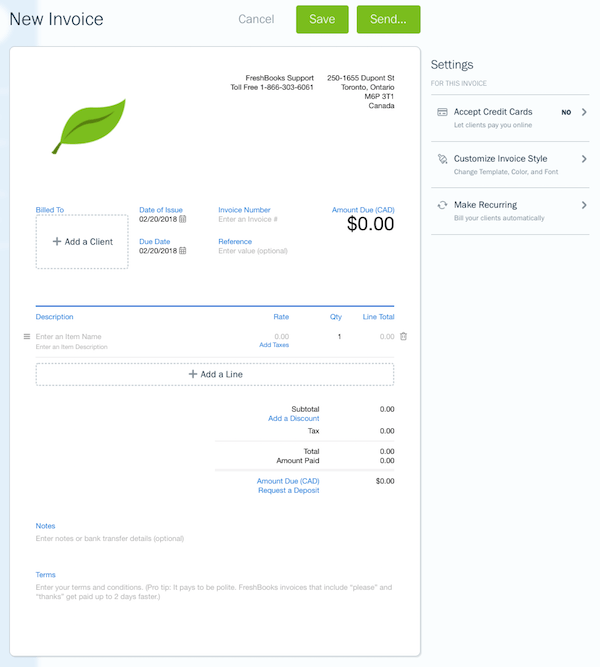

The plan includes unlimited expense tracking, unlimited estimates, accept credit cards and bank transfers, track sales, see reports and send unlimited invoices to up to five clients. We analyzed 13 providers across 20 metrics to rank the best accounting software for small businesses. Our ratings consider factors such as transparent pricing, variety of features, availability of support and customer ratings. Accounting costs vary greatly depending on the type of services you need. According to a 2015 survey of small business owners, most small businesses spend at least $1000 annually on accounting and legal expenses.

What does an accountant do?

The ability to extract, interpret, and utilize this data is a key skill for modern accountants. They must navigate the complex world of federal, state, and local taxes, ensuring that the business remains compliant while maximizing available deductions and credits. Every industry has unique financial nuances, and being able to navigate these can make an accountant an invaluable asset.

Sage Intaact’s robust dashboard is optimal if you want to access comprehensive financial visibility and data-driven insights across multiple businesses. And if you are looking for scalability and cost-effectiveness in your solution, one of Xero or Wave Accounting’s free or low-cost software plans may be the right choice for your business needs. Its lowest-priced plan, the Early plan, does limit Accountant for small business the number of invoices you can send per month, but it’s a great, cost-effective option for new users with fewer or smaller accounts. And if you require more software functionality, scaling up is easy, as Xero supports unlimited users and has relatively low prices across each plan. Automatica’s all-in-one cloud ERP solution provides many great features for managing multiple growing businesses.

Comparing Costs Among Accountants

Unless you are a CPA who is up to date on tax laws, you’re likely missing out on deductions and other small biz benefits. And once your business starts growing, you likely won’t have the time or knowledge to accurately keep track of all your books. Hiring a small business accountant is a valuable investment for most businesses. They can save you time, reduce stress, ensure compliance with tax laws, maximize tax savings, and provide crucial financial insights.

Of course, the most authoritative source for information about the ERC is the IRS. However, it can still be challenging to know whether your business ought to apply for the ERC — and that’s where a qualified tax expert like Soria can help. It’s understandable if businesses want to take advantage of the tax breaks that are available to them. The Employee Retention Credit may be one of those tax-break opportunities for qualifying businesses that continued to pay employees while shut down due to COVID-19 or saw declines in revenue. If you make those payments on time, then you shouldn’t have to worry about a hefty tax bill when you file your federal return.

Ways Small Businesses Can Handle Accounting

Below you’ll find summaries of these applications, with an explanation of what makes them differ, along with what to look for when choosing the right software for your business. We also include links to the in-depth reviews of each software if you want to learn more. While many small-business owners opt to do their own accounting and bookkeeping, there may come a time when you decide to hire out these services.

$80bn for the IRS? Fund the US taxman, but not like this – The Guardian

$80bn for the IRS? Fund the US taxman, but not like this.

Posted: Sun, 20 Aug 2023 12:00:00 GMT [source]

You’ll need to consider factors directly affecting your business and the accountant’s services. You might want an accountant for any of the reasons we discussed above. Further, if you have had any big life changes recently, you’re self-employed, or you need to make changes to a previous year’s tax return, it’s also good to employ the services of an accountant. Hiring a bookkeeper may be a cost-effective solution for your business.

They translate complex financial data into understandable terms, helping business owners make informed, data-driven decisions. This ability to translate financial data into actionable insights is what makes an accountant truly valuable to a small business. These principles guide their work and enable them to provide accurate, relevant financial information.

How much experience does the tax advisor have delivering the kind of results I’m looking for?

Some accountants may charge a flat fee along with additional, variable rates. From here, you can consider how each solution would support these needs. For instance, the advanced features offered by Zoho Books make it a good option for streamlined data consolidation.

- Appendix 16 provides for two-digit number designations for major categories under which accounts are listed, and three-digit number designations for individual general ledger accounts.

- Nothing compares to using the products when considering which is the best.

- You just have to decide whether you want to spend the time upfront building your records or take time out when you’re in the middle of sales or purchase forms.

Fixed fees, on the other hand, can provide more certainty and can be more cost-effective for ongoing, predictable services. Referrals and reviews can provide valuable insights when choosing a small business accountant. Are they able to understand your concerns and provide clear, helpful responses? A good accountant is not just a numbers person—they’re a people person, too. An accountant’s past performance can give you an idea of their competence and effectiveness.

Accurate accounting helps you do a lot, including maximizing tax deductions and making better financial decisions. They are the balance sheet, cash flow statement, and income statement. Are you aware that many business owners simply file their personal and business taxes together in one return? These types of businesses are referred to as “pass-through” entities. In late 2017, the Trump administration introduced the Tax Cuts and Jobs Act (TCJA). Although there are certain restrictions, the TCJA allows for a new tax break for small business pass-through entities, an equivalent of up to 20% of its income.

All the accounting services reviewed here come with default settings that you may need to change. For example, do you plan to use specific features such as purchase orders and inventory tracking? You can usually turn tools on or off, which can help you either simplify the user interface or maximize the functions available to you. There’s good news for business owners who want to simplify doing their books. Business owners who don’t want the burden of data entry can hire an online bookkeeping service.

Inventory tracking, accounts payable and receivable reporting, as well as tax preparation and filing, are add-on options for an additional fee. That’s a comprehensive offering for startups or small businesses that want to scale up quickly. The next step is to work with your account manager to integrate your existing software and processes with QuickBooks. From that point on, you will receive monthly reports, including cash flow, profit and loss, and balance sheet statements. For additional fees, inDinero offers tax support for filing state and federal taxes for current or previous years. You also can add a fractional CFO to help with financial projections, cash management, business analytics, and budgeting.

What is your current financial priority?

A bookkeeper records business transactions and day-to-day operations. Their job is to manage bills, payroll, invoicing, and transactions with suppliers. Most bookkeepers monitor cash flow, create budgets, and manage accounts payables and receivables.

Kashoo is ideal for startups because it offers a variety of plans to grow with your business–including a free plan. Its trulysmall.invoices plan is perfect for sending an invoice, getting paid and tracking payments. Its trulysmall.accounting plan allows you to track income and expenses automatically. If your business needs double-entry accounting software, its kashoo plan allows for detailed reporting and customization.

Professional services biz BlueRock seeks growth capital partner – The Australian Financial Review

Professional services biz BlueRock seeks growth capital partner.

Posted: Sun, 20 Aug 2023 19:00:00 GMT [source]

It’s the most comprehensive, customizable accounting program in this group of applications, though it does more than what many small businesses need, and it costs a bit more as well. The software offers built-in online connections that support some remote work, and it integrates with Microsoft 365 Business. Sage 50cloud Accounting is a powerful piece of software, so why didn’t it receive a higher rating? A dated interface, lack of mobile access, and the requirement to install the software locally keep it from receiving a higher score. FreshBooks is actually a full-featured, double-entry accounting system that happens to offer an exceptional user experience. It has won numerous PCMag Editors’ Choice awards for these reasons.