Assessment

On , Cohen Milstein and co-counsel registered a 3rd revised class step ailment within this user protection group action, alleging one to GreenSky, a financial technical team, operates in the Ca just like the an unlicensed and you will unregistered borrowing properties business, fund lender, and agent, and you can partcipates in like techniques within the citation of one’s Ca Financing Law (CFL) and you will Borrowing Attributes Work from 1984 (CSA).

Plaintiffs claim that GreenSky brings in the majority of their income from the 1) battery charging good provider payment on each loan typically, 7% of your own full loan amount, and you may dos) getting bonus payments away from bank partners normally greater than brand new $50 otherwise $75 commission greet under the CFL.

Merchants pass on the expense of the retailer charges so you’re able to individual-consumers as a consequence of high enterprise can cost you, which in turn creates highest project costs, which in turn, entail expands regarding the overall count individual-individuals use by way of GreenSky-system money and you can, correspondingly, this new dollar quantity of an individual-borrowers’ repayments into those financing.

Essential Rulings

- , the latest Ninth Routine stopped and remanded this new section court’s acquisition granting GreenSky’s activity so you’re able to force arbitration.

- , new region legal declined simply Defendant’s action for limited judgment towards the pleadings.

Situation Records

Generally speaking, the fresh new CFL and CSA need lenders, agents, and you will borrowing characteristics communities to get signed up, fused, and you may entered towards the Ca Agencies off Fairness otherwise Service out of Company Oversight; ban misrepresentations and deceptive and you will deceptive serves concerning and come up with and you may brokering money; and provide approaches to customers damaged by unlawful credit practices.

One another statutes including reduce characteristics and quantity of costs one lenders, brokers, and credit qualities organizations may charge customers having credit, brokering, obtaining, otherwise assisting people having acquiring finance, and need all costs with the taking these services to-be announced.

Plaintiffs claim that GreenSky works inside Ca because a keen unlicensed and you may unregistered borrowing from the bank properties providers, money bank, and you will broker, and you can partcipates in methods prohibited by CFL and also the CSA.

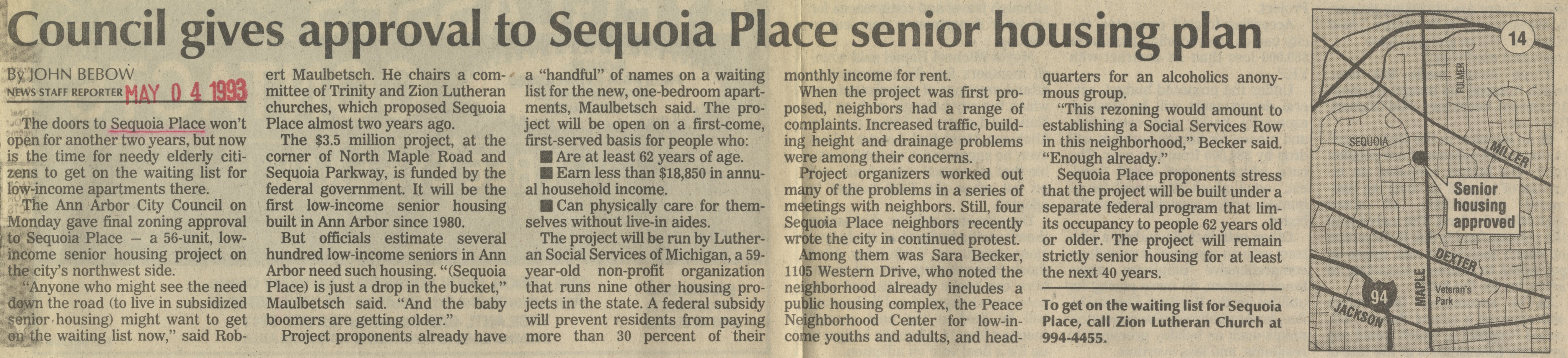

Particularly, Plaintiffs point out that GreenSky has built a multiple-billion-dollar providers integrating which have a dozen credit organizations, along with local banking companies SunTrust (today Truist), 5th 3rd, and you can BMO Harris, and over 17,000 merchants, along with Domestic Depot and Roto-Rooter, supply area-of-business funds to people who wish to funds home improvement ideas and fixes, solar-committee installations, and you may elective healthcare.

Merchants within the GreenSky’s program hook their customers which have easy bad credit loans in Thornton GreenSky’s bank people using GreenSky’s cellular application, that allows GreenSky to orchestrate the entire credit techniques, off application to help you resource, within just moments.

GreenSky produces the majority of its earnings of the charging a great merchant percentage on every mortgage, which is calculated because the a percentage of amount borrowed. The nature and you will quantity of it payment isnt shared in order to the user at any part of new lending processes.

Merchants spread the cost of the retailer fees so you’re able to consumer-consumers by way of large enterprise will cost you. The greater endeavor costs, in turn, entail increases regarding complete matter consumer-borrowers obtain by way of GreenSky-program financing and, correspondingly, the brand new buck number of an individual-borrowers’ payments towards the those funds, just like the financing payments is actually a function of the borrowed funds dominating.

Plaintiffs after that claim that GreenSky plus agreements using its bank partners, via loan origination plans, to receive incentive money. Individuals are not aware of these mortgage origination agreements, hence brand new charge one GreenSky gathers are usually greater than the newest $50 otherwise $75 fee desired underneath the CFL.

Even with creating the services of a broker, borrowing from the bank features team, and you will financial, GreenSky is not joined once the a credit characteristics providers, or subscribed while the a funds representative otherwise lender, during the Ca.

Inside the contribution, even with just what GreenSky says, and you may despite not-being licensed to do so, GreenSky brokers and you may facilitates finance having consumers along side condition, stretching credit without having to be inserted, and you may battery charging large undisclosed charge, within the admission of your own CFL, CSA, and individual shelter laws and regulations.

Instance title: Belyea, ainsi que al. v. GreenSky, Inc., et al., Situation No. 3:20-cv-01693-JSC, Us District Legal for the North District out of California