To find a property inside an effective seller’s markets can be difficult. While you are housing market requirements tends to be less than top, there are still advantages to to get property as opposed to leasing. Use these suggestions to stand out from the crowd and you can residential property the house you have always need.

The decision to purchase a property shall be one another fascinating and you may terrifying all at the same time. Homeownership is really what a lot of us strive for-to be able to has a home that we is also phone call our own, together with a genuine estate asset we are able to use to create our personal wealth. It is a giant step to take. At the same time, even when, the process of to shop for a home will be daunting. Understanding the action-by-step processes from inside the to get a house might help improve household-to order sense a far more confident one for you along with your members of the family and certainly will help to lower the excess be concerned that comes with huge instructions in daily life.

personal loans in Oakland TN with bad credit

Va financing against. antique loans

Pros and you can service people in the newest Army and their spouses qualify for authorities-backed Virtual assistant money, and that range from old-fashioned mortgage loans in lots of ways. Each other possibilities allows you to get a home, nevertheless they feature different conditions and terms that will apply to your summation. Find out about the advantages of a beneficial Virtual assistant mortgage against. a traditional financing to get the correct selection for both you and the ones you love.

Va loan qualification standards

While you are an armed forces member or seasoned, you . Virtual assistant financing come with straight down eligibility requirements to greatly help solution players and their family be able to buy a property no matter if they have little money in offers otherwise a leading credit score. Try to be sure you fulfill all Virtual assistant mortgage criteria to acquire accepted. Discover more about the brand new Virtual assistant financing conditions to see if you qualify.

What is an enthusiastic FHA home loan?

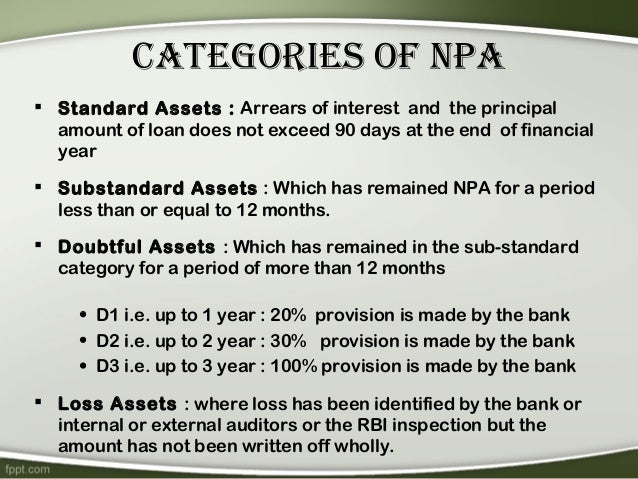

An FHA home loan are one financial supported by this new Government Housing Expert (FHA) , that is a part of the new U.S. Company out-of Housing and you may Urban Development (HUD). FHA-approved individual loan providers administer these types of loans , nevertheless bank are not kept financially responsible in the event that a borrower default s with the mortgage. Government entities requires economic obligation therefore individual lenders offer finance so you can Us citizens with lower borrowing without worrying regarding the incurring a loss of profits. Consumers which have poor credit or bankruptcy proceeding on their number will get if not have trouble delivering accepted for a financial loan. The newest FHA financing system sooner expands entry to homeownership by providing these users entry to reduced-attract funds.

How do you be eligible for an FHA financial?

When you yourself have a diminished credit score otherwise a premier debt-to-money ratio, you will find a simpler day bringing recognized for an FHA financing than simply you’d having a traditional mortgage. An enthusiastic FHA financing is more easy to your a lower life expectancy credit score, or if perhaps you’ve got early in the day credit occurrences including bankruptcy proceeding or foreclosure. Due to the fact an enthusiastic FHA mortgage are a government-supported mortgage, you might not meet the requirements for those who have outstanding otherwise recharged-out-of college loans, and other government fund such as for example a Va or USDA mortgage. You must be also current in your federal taxation.

The brand new appropriate personal debt-to-earnings limitation utilizes your credit score. For those who have a reduced credit rating you really must have facts of a reliable income source to find approved. When you yourself have a leading credit score you can tend to score acknowledged having a high personal debt-to-earnings proportion.

Perform FHA fund keeps down interest rates?

FHA financing both enjoys straight down rates than other home loans , nevertheless the annual percentage rate (APR), with the speed and additionally costs, could be large. To track down a better notion of the interest rate according to your unique financial predicament, contact a mortgage loan administrator from the Ent .