Article Mention: The message with the article will be based upon the brand new author’s feedback and you will information alone. It might not have been analyzed, accredited emergency cash for unemployed single mothers or otherwise endorsed by any one of the system partners.

Applying for a special mortgage is a daunting techniques, especially if you has actually a shorter-than-most readily useful credit history. When you are seeking buy property in the place of a credit history anyway, although, you may find the process to be even more challenging.

While you are there are particular loan applications and lenders which have lowest borrowing rating conditions, there are ways based on how to leave home financing with zero credit rating. We have found a glance at what to expect regarding the procedure and you may your options you will have.

- How to get a home loan without credit history

- Loan apps that allow having home loan approval with no credit score

- How-to confirm the credit without a credit score

- How loan providers ensure nontraditional borrowing from the bank records

- Preciselywhat are specific explanations you will possibly not provides a credit score?

- How to build credit

Getting a home loan without credit history

You will find several certain matters you can certainly do while you are hoping to get a mortgage without credit rating. Here are some tips out of the direction to go.

Rating good cosigner

If you really have poor credit if any credit history whatsoever, incorporating a great creditworthy cosigner into mortgage loan is you to way to change your approval odds.

A good cosigner was an individual who agrees to fairly share obligations for the financing and its own fast installment – even though you might be usually the one theoretically and come up with repayments every month. Your own cosigner could be a spouse, mother or father, sis if not a good friend that is willing to feel put into your own mortgage. It is vital to observe that the loan and its particular cost background might possibly be advertised to their credit, also.

Enjoys a massive downpayment

The bigger the down payment you promote and then make toward good family, the newest less chance the lender must take towards the through providing your a mortgage. If you decide to default on your own financing cost, the lending company have a far greater danger of recovering their cash in the event that you have currently contributed a significant part and you can/otherwise discover famous equity established in the home.

If you’re struggling to qualify for a unique real estate loan with your established credit score, offering a giant down payment could help change your chances. While doing so, specific loan providers and you may real estate loan situations may need a more impressive down commission if your credit rating is leaner.

Proceed through a hands-on underwriting processes

In mortgage underwriting process, a lender assesses good borrower’s amount of exposure in regards to payment of its this new financing. It indicates looking at items for example earnings, a career condition, current loans or any other expenses to see if the fresh new borrower is fairly make monthly premiums in the place of struggling.

Items you Should be aware of

Of several lenders today use automated underwriting systems, hence make use of computer software to help you 1st vet home mortgage people. not, these solutions are made to see red flags, eg a reduced otherwise nonexistent credit history, and will bring about a denial of one’s loan application. From the requesting a handbook underwriting process – and therefore a human underwriter experiences the applying on their own – you may be able to avoid an automated denial. Such underwriters are able to use their unique judgement in evaluating your application, offered all situations offered.

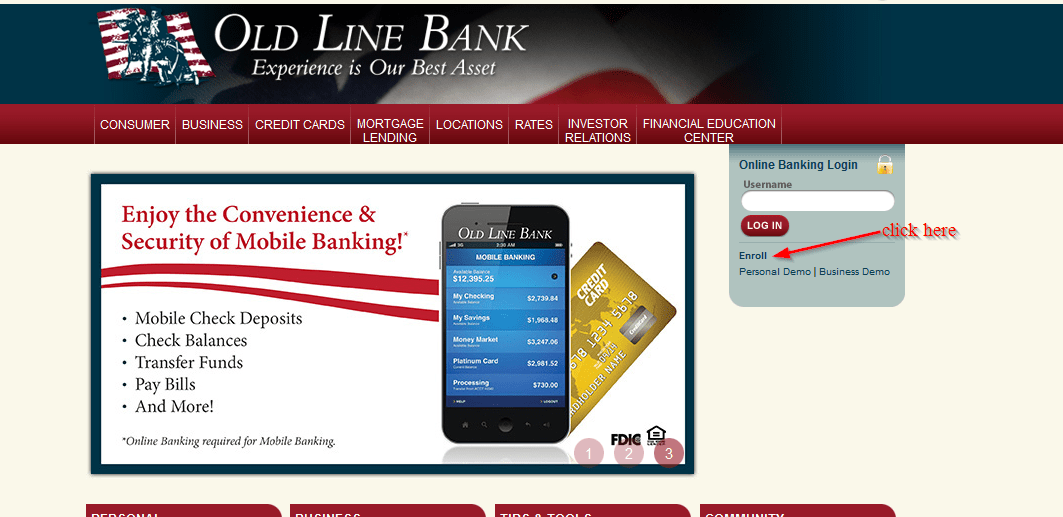

Have fun with credit unions otherwise on line lenders

For those who have a current experience of a credit union or local lender, you’ve got a far greater chance of mortgage loan acceptance here. That is because credit unions will often have a great deal more flexible lending standards and you can a far more customized method. When you yourself have almost every other circumstances in that institution – like an auto loan otherwise bank card – while having an excellent commission background into those people account – the college tends to bring this creditworthiness into account.