Could you be struggling to find and you will pay for pretty good, safer, hygienic casing? Therefore, then you definitely ent financing. Certification relies on the area in your geographical area, there also are money constraints.

In this post, we are going to display who’s eligible, the key benefits of an outlying Creativity mortgage, and exactly how borrowers may use the mortgage money.

What is actually an effective USDA Outlying Advancement Loan?

The us Company out-of Farming now offers a rural Creativity financing system one helps loan providers in providing reduced- and reasonable-income domiciles the opportunity to individual sufficient, more compact, pretty good, as well as hygienic dwellings as their pri, brand new USDA assisted 127,000 group get otherwise fix their houses, but, of numerous eligible Us americans however don’t know that system is available.

Particularly more federally guaranteed mortgage software, individuals do not need to make a downpayment to help you safe the lowest-rate of interest financing. In the event your debtor decides to loans in Clewiston, they are able to create a downpayment, however, lenders none of them they.

Why does it Functions?

Just like Virtual assistant and you may FHA loans, government entities claims Outlying Advancement loans, and you will individuals are not required to make a deposit. Brand new make certain protects mortgage loan providers off consumers who will get standard on the mortgage repayments.

Outlying Invention loans individuals may have to spend a mortgage insurance policies premium and their month-to-month home loan repayments. The borrower pays the latest month-to-month premium, nevertheless insurance rates actually protects the lender. If the debtor default towards financing, the loan insurance create afford the lender the main financing dominating.

Borrowers may use new USDA financing money to invest in a home or perhaps to renovate, resolve, or enhance their established primary house.

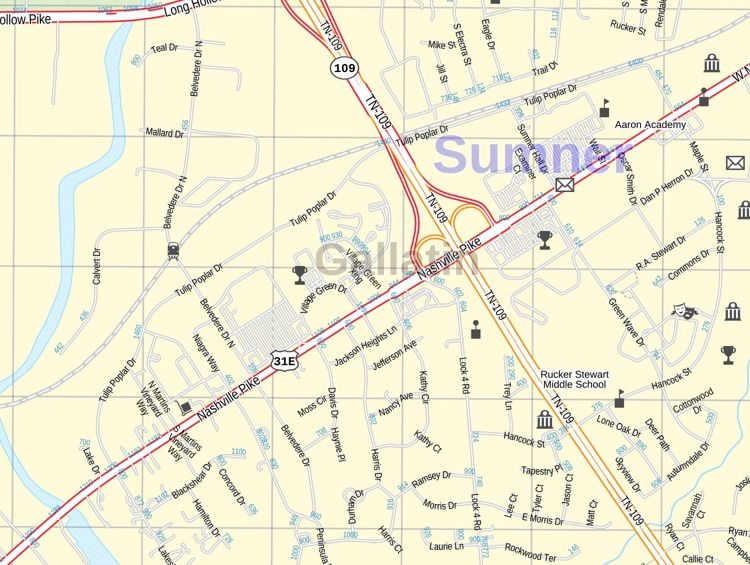

Outlying Advancement Qualified Parts

The new USDA Rural Innovation loans are around for individuals who alive from inside the outlying section. Citizens of area elements aren’t generally entitled to the program, but it is you’ll to acquire brief purse out-of qualifications when you look at the suburban parts. Look at the USDA web site to see if you reside a keen qualified town.

Constantly, eligible land keeps 2000 square feet from living space or reduced. The utmost dollars amount of the mortgage varies considering an enthusiastic applicant’s geography because makes up about the latest area’s cost-of-living. Instance, somebody residing in Ca will get qualify for a loan as much as $five hundred,000 because cost of living try higher, when you find yourself those who work in less costly midwestern parts get qualify for an excellent maximum from $100,000 from financing money.

Who’ll Pertain?

Surprisingly, you don’t need to getting a great rancher otherwise a farmer when planning on taking advantage of the fresh USDA Rural Creativity finance. Qualifications is dependant on location and you will income, perhaps not industry.

USDA Outlying Creativity financing individuals normally have to generally meet money eligibility standards, and this differ considering topography and domestic proportions. Candidates need inhabit the home as their top residence. Americans, non-citizen nationals, or Licensed Aliens get apply for the mortgage.

Loan providers can help a borrower dictate how big is mortgage he otherwise she actually is eligible for based on location and economic function. Most of the time, good borrower’s monthly homeloan payment (which has the main, attract, insurance, and you will fees) should not be any more than 31% regarding their unique monthly income.

The minimum credit score you’ll need for a good USDA loan is 580, however, those with large ratings tend to qualify for greatest terms. You aren’t a get regarding 640 or quicker might need much more tight underwriting, therefore financing recognition takes longer. If you don’t features a credit rating, you may still manage to be considered having a good non-traditional borrowing source detailed with their electricity otherwise leasing percentage records.

Not totally all rural residents try applicants to possess a beneficial USDA home loan. Potential individuals always you would like a history of trustworthy income for a minimum of two years before applying for a financial loan. Of many lenders also require your debtor has not had one expense provided for a profile company to possess 1 year before you apply for a financial loan.

How do you Utilize the Funds?

Consumers may use the mortgage fund to order an alternate otherwise established assets, provided its his or her number 1 residence. The loan money could also be used to aid the fresh new borrower spend settlement costs or other realistic costs associated with a typical domestic selling. Individuals can even utilize it to possess professional-rata a home fees in the closure, as well as the risk and you can flood insurance premiums.

- Solutions otherwise renovations from a preexisting house

- Refinancing qualified finance

- Especially customized possess or equipment to suit children member who has an impairment

- Realistic charge so you can reconnect tools (liquid, sewer, fuel, electrical), also professional-rata cost will set you back

- Important family devices, for example carpeting, oven, fridge, washer, dryer, or Heating and cooling devices

- Web site planning into a different sort of domestic generate seeding or sod, grading this building webpages, fences, otherwise driveway