Closing Current Revolving Kinds of Borrowing

While settling your debt is superb, you might want to be reluctant in advance of closing one revolving forms of borrowing from the bank. These include playing cards plus lines of credit. Closing a preexisting mastercard (or line of credit) reduces the common chronilogical age of the credit membership, and the earlier the newest account, the greater obvious the end result. Additionally, closing a current account will get improve credit utilization price, which, in turn, possess a poor affect your credit score. This is why, if you plan to shut almost any rotating borrowing from the bank account, think waiting up until the closure of one’s financial.

Missing Making Repayments

Commission record plays a switch part from the calculation of the credit history it is therefore important to build your entire payments timely. They’re mastercard and financing payments along with electric debts. Keep in mind that also an individual late percentage provides a negative impact on your own credit rating, that is certainly a bigger condition than just you imagine when the it occurs following the pre-acceptance of one’s financial and you may in advance of the closure.

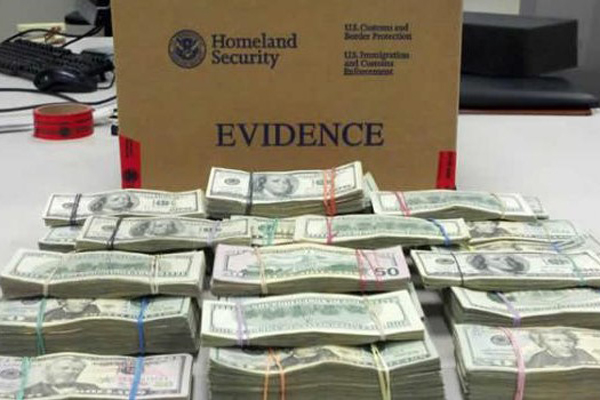

Depositing tons of money

When you’re and come up with an enormous deposit into the savings account during the procedure of delivering a mortgage, expect a lot more scrutiny. If you find yourself payroll dumps and you may bank account transfers are typically okay, prepare yourself giving a reason while you are and also make any other type off large put. Even although you has actually a perfectly valid reason, the newest so you can-and-fro constantly leads to slowing down of your processes.

The reason for the new analysis is actually loan providers desire to guarantee that the money is inspired by a valid and you will documented provider. Should your put is sold with a newsprint trail, you’re always all set. If you are anticipating acquiring a gift to support your off percentage or intend to deposit dollars which you have already been saving to own years, it is better that you tell your loan officer regarding it during the the beginning to stop any difficulty during the a later phase. If you don’t intend to use the money to own down payment, thought postponing placing it in the account through to the closure of your own mortgage.

Maybe not Anticipating Correct

A great 2021 Bankrate/YouGov survey suggests that 33% of little one boomer buyers (57 age to 75 years of age) have some regrets regarding the loans Central City household they buy, hence amount grows to 64% which have millennial homebuyers (twenty five years so you can forty years old). If you’re 21% from millennials mentioned that fix costs are higher than projected, 13% believe that its mortgage payments are way too high. 13% out of millennials including genuinely believe that they find yourself overpaying due to their house.

Be aware that after you pick property, it’s not simple to recuperate your money of the looking to sell it quickly. Actually, if you have to promote your residence since you are unable to remain with their home loan repayments, there is a chance that you’ll finish losing profits from the procedure due to the fees and you will taxes of to purchase and you will promoting property. For this reason, its imperative to determine how high priced a property it’s possible to manage before you apply to have home financing.

You should essentially understand how private home loan insurance coverage (PMI) and loan items functions before you apply for a home loan. Loan circumstances assist loan providers slow down the interest levels of financing and you will are generally best made use of if you intend to reside in the brand new household you purchase getting eight many years or even more. PMI, concurrently, enables you to pay less than 20% because down-payment. You end making money on their PMI once you to get 20% collateral of your house.