- What is a cash-aside refinance?

- Benefits and drawbacks

- Which qualifies?

- Cash-out refinance vs. additional options

- Completion

User backlinks to your points in this post come from people one make up all of us (discover our marketer disclosure with these directory of couples for more details). Although not, the viewpoints was our own. Observe how i price mortgage loans to type unbiased ratings.

- An earnings-out refinance substitute your financial with a brand new, large financial.

- This process enables you to turn some of your residence security to the bucks from the closure. Usually, you can’t remove more than 80%.

- Cash-out refinances are going to be a good replacement household equity financing otherwise signature loans, but you can find drawbacks.

If you prefer entry to bucks to arrive larger monetary specifications, there are plenty of a means to borrow cash, including using a credit card or taking right out an individual mortgage.

Whether your house’s worth has grown because you got it – or you have paid back the home loan significantly, you may be able to find the cash you desire due to a profit-out re-finance on your mortgage.

Cash-out refinance prices was below playing cards or unsecured loans. They are also typically lower than family guarantee money otherwise HELOCs while the these include earliest mortgages, very these are generally felt much safer on lender.

What is actually a money-away refinance?

There are two main brand of refinances: Rate-and-label refinances and money-aside refinances. Rate-and-title refinances are accustomed to alter the rate of interest and you can terms and conditions of the financing – usually and also make your own monthly premiums cheaper or even to shell out less when you look at the appeal. Cash-aside refinances allow you to obtain out of your home collateral.

Meaning

A money-aside re-finance was a home loan one to enables you to turn the newest collateral of your property to the cash from the closing. That have a cash-out refinance, you are taking out home financing bigger than the total amount you still owe in your family, while receive from inside the dollars the difference between what you owe on the most recent mortgage and the fresh new bucks-out financial.

How it operates

The amount you may be permitted to discover in bucks could possibly get rely on your own bank, but in most cases away from flash, you can’t acquire more than 80% of your home’s well worth. In that way, you keep at the least 20% of your own guarantee at your home.

What if you reside respected at the $250,000, and you have $100,000 kept to expend on your own very first financial. This means you really have $150,000 home based collateral.

To find the maximum matter you could sign up for, multiply your house’s value of the 80%, otherwise 0.80. Next, deduct your existing mortgage balance to ascertain simply how much you could access closure.

Thus within example, you could take-out a loan doing $2 hundred,000, pay your $100,000 mortgage, and you will pouch the remainder $100,000.

Keep in mind that you’ll nonetheless afford the additional will cost you that incorporate taking out home financing, as well as appraisal charge, origination charges, and settlement costs.

Uses for bucks

The cash you can get that have a finances-away refinance may be used however you pick complement. Tend to, home owners uses so it dollars getting things such as debt consolidating or and then make home improvements.

Just how a funds-away refinance really works

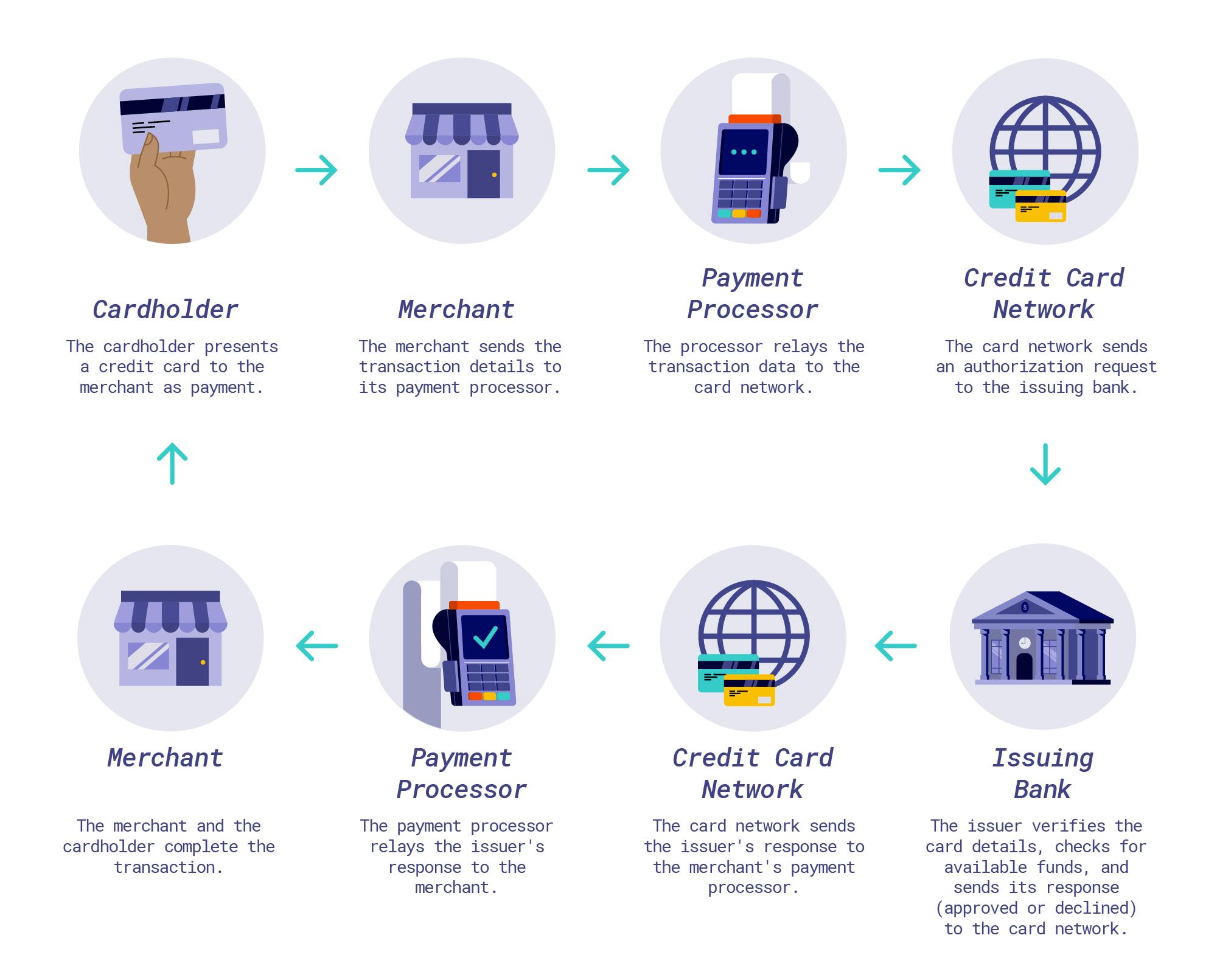

A cash-out refinance work comparable to taking right out a vintage mortgage does. Look for lower than to own an introduction to the process:

Software processes

Earliest, you can fill out an application with a lender, and you will submit people documentation they want. This means shell out stubs payday loans Lester, W-2s, tax returns, and you may bank statements, always.

Your own lender will likely then purchase an appraisal to ensure the home’s really worth, and begin in order to underwrite the loan. At that point, your loan administrator get request significantly more paperwork or possess concerns to own your. Make sure to function easily to get rid of any delays. In the end, you’ll romantic into the loan.