Considering to buy another house? Navigating the industry of mortgages should be challenging, however, understanding the ins and outs of antique fund tends to make their travel smoother. Contained in this situation, we are going to read a conventional mortgage definition, their advantages and disadvantages, and you can what to bear in mind when implementing.

Traditional Financing Definition: Unpacking the prerequisites

What is a conventional mortgage? It is one mortgage loan that’s not insured or protected from the bodies (for example significantly less than Federal Homes Government, Department out of Veterans Issues, or Company from Agriculture loan software).

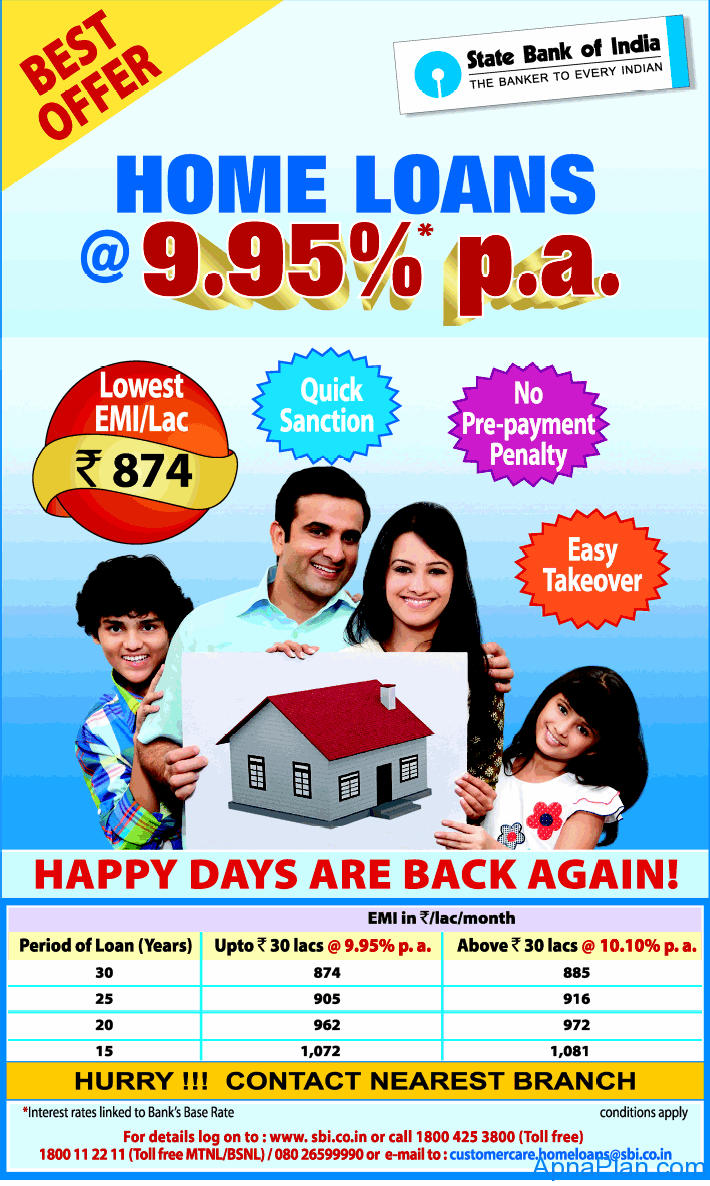

- Winning interest rates-fixed view publisher site otherwise varying;

- Installment term-fifteen otherwise 30 years.

- Highercredit get

The minimum score selections out of 620 so you can 640, and better things cause most useful interest rates. Your credit history shows brand new borrowing records, very a reputation quick payments and you can in control obligations administration bodes better.

- Willingness to make the first payment

Antique loans allow for an advance payment of up to 3%, but in this example, you should pay private home loan insurance (PMI). It a lot more fee every month protects the lending company if there is standard and reduces the monthly payment.

- Restriction debt-to-earnings ratio (DTI)

DTI was a financial indication you to methods monthly debt burden opposed in order to gross monthly money. 43% is the limit DTI for a normal home loan, and thus your month-to-month financial obligation repayments cannot go beyond 43% of your monthly pre-tax earnings. It speaks into ability to create finances and pay off borrowing.

- Obtaining a reliable money

Along with the the second activities, loan providers also consider brand new volume of your own salary and other money. Your ability to settle a cards more an extended several months hinges on your monetary stability. A-two-12 months a career record is often named an indicator of money balance.

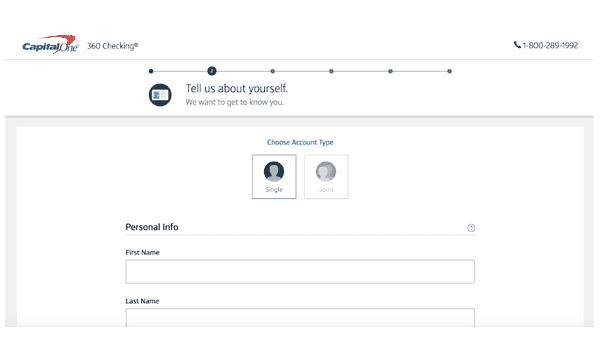

Paperwork requirements

Since i have replied practical question, What’s a conventional financial? let us focus on the expected documents. While the home loan landscaping changed while the 2007 subprime crisis, might paperwork requirements to have old-fashioned fund are still seemingly undamaged.

- A home loan application is a proper mortgage consult, usually accompanied by a control fee.

- Files verifying income:

- Invoices getting earnings (money having a month, earnings for the most recent year);

Antique Loan Choice

What is old-fashioned resource meaning for many People in the us? Balance, independence, and you may positive terminology. It is an effective selection for potential property owners. Thus, let’s mention antique mortgage choices.

Follow Fannie mae and you will Freddie Mac direction, which have loan restrictions (such, $726,200 into the 2023). Suitable for a borrower which have a cards who does not require a large financing.

Exceed the maximum constraints lay by the Fannie mae and you can Freddie Mac. This makes this package far more risky having lenders, so consumers which have eg loans usually deal with more strict certification criteria. Although not, highest finance dont constantly include large prices. This mortgage is perfect for borrowers who are in need of a lot more currency to get more costly a property.

Are given by bank and gives so much more self-reliance to be considered (such, lower down costs). Even so they may have high interest levels. It is that loan you to remains about financial which is not obsessed about the fresh new secondary markets.

Give balances in the entire age credit authenticity while the interest remains unchanged. It gives foreseeable monthly payments, so it is the ultimate option for a borrower which thinking ??clear traditional and you can cost management.

Give a lesser first interest rate than simply fixed. They can change throughout credit legitimacy. This is exactly beneficial for a debtor whom plans to re-finance otherwise offer the house until the stop of one’s basic several months on a fixed speed. However, weighing the risks is essential, as your monthly obligations could possibly get increase, to make budgeting difficult.

Weigh advantages and you may Cons out of Conventional Fund

Research of the trick positives and negatives off old-fashioned financing and you will consider all of them up against the money you owe and you may specifications will help you know if these financing is the proper choice.

Experts

The newest deserves was unquestionable, as they allow debtor to construct collateral because of the managing an excellent domestic from the beginning. But not, like any borrowing offer, such mortgage has particular downsides.

Disadvantages

Keep in mind that never assume all conventional financing have got all such cons. Certain lenders offer even more flexible terminology, and you will business conditions connect with access and rates.

Latest Imagine

Therefore, what is actually a traditional loan? For those who see antique home loan meaning, it will become obvious that the has the benefit of potential a house people freedom and you will versatility of choice. You could potentially pick the fresh functions you need, comprehending that you have access to advantageous conditions and you will stable notice cost.